Health insurance is more than a safety net; it’s your frontline defense against rising medical expenses. In 2025, Maryland residents face new challenges and opportunities when it comes to finding quality health coverage. From updated state marketplace offerings to shifting premiums and benefits, the landscape has evolved significantly.

Whether you’re self-employed, supporting a family, or simply looking to upgrade your current policy, understanding the best health insurance in Maryland can help you save money while ensuring comprehensive care. But with so many options available, comparing and selecting the right plan can feel overwhelming.

This guide breaks down the top health insurance plans in Maryland for 2025, based on value, flexibility, and real-life coverage needs. You’ll learn how to compare plans, what to watch out for in terms of cost and benefits, and how to choose a plan that fits your lifestyle. Let’s dive into the smartest health insurance choices for Marylanders this year.

Why Health Insurance in Maryland Is Important in 2025

As healthcare continues to evolve, having reliable health insurance in Maryland is more important than ever. In 2025, several policy updates under the Affordable Care Act (ACA) are influencing how residents access care and what coverage options are available.

Maryland health insurance providers are adapting to growing consumer expectations—offering more flexible networks, preventive care services, and mental health coverage. Many ACA plans in Maryland now include expanded coverage benefits for telehealth, behavioral health, and chronic condition management, making it easier to get care when and where you need it.

For individuals and families, understanding the coverage benefits of each plan is essential. From lower out-of-pocket costs to broader provider networks, today’s health insurance options are designed to meet a wider range of medical and financial needs.

Whether you’re new to the Maryland marketplace or simply reassessing your current policy, 2025 brings new opportunities to get better value from your health insurance.

Types of Health Insurance Plans Available in Maryland

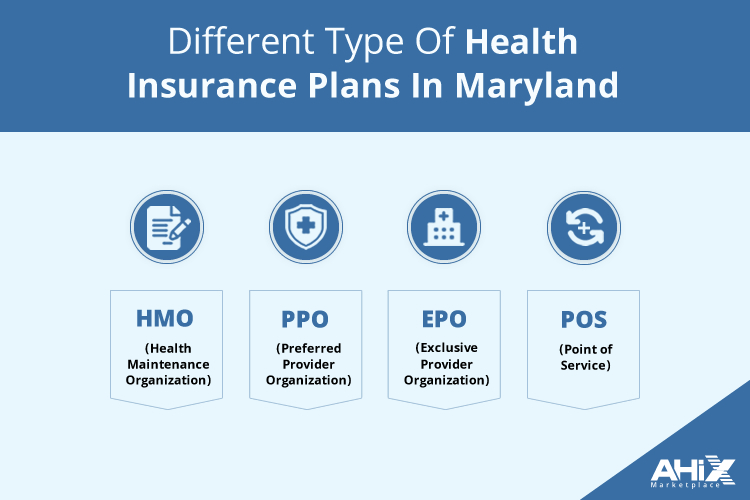

When shopping for coverage, it’s essential to understand the types of health insurance plans available in Maryland, especially if you’re aiming to balance affordability with flexibility in 2025.

Here are the most common plan types offered by insurers across the state:

- HMO (Health Maintenance Organization): These plans offer lower monthly premiums and out-of-pocket costs but require you to stay within a defined provider network. If you’re comfortable coordinating care through a primary physician, an HMO plan in Maryland might be the right fit.

- PPO (Preferred Provider Organization): PPOs allow greater flexibility in choosing healthcare providers, even outside your network. While premiums are higher, you get the freedom to visit specialists without referrals. This makes PPO plans a strong option for those who want wider access to care in Maryland.

Still unsure about HMO vs PPO?

You can read this helpful breakdown:

Dental HMO vs PPO: Which Plan Is Best?– while it focuses on dental, the structure and pros/cons apply to medical plans as well.

- EPO (Exclusive Provider Organization) and POS (Point of Service) plans also exist, offering hybrid structures depending on the provider network and cost-sharing terms.

Choosing between HMO vs PPO in Maryland often comes down to how much flexibility you need and how often you require specialist care.

Additionally, Maryland residents can choose from:

- Private health insurance plans in Maryland are offered by major carriers and provide flexible coverage for individuals and families who prefer to buy directly or through brokers. These plans often include broader provider networks and optional benefits like dental or vision.

- Individual health insurance in Maryland is best suited for self-employed individuals, gig workers, or those without employer-sponsored coverage. These plans offer essential health benefits and may qualify for financial help through the Maryland marketplace.

- Family health insurance Maryland policies are designed to cover multiple household members under a single plan. They include key services like pediatric care, preventive screenings, maternity coverage, and more to protect your entire family’s health.

Understanding these plan types helps you match your medical needs with a policy that fits your lifestyle and your budget.

Affordable and Low-Cost Health Insurance Options in Maryland

If you’re looking for the best health insurance in Maryland, the best starting point is the Maryland Health Connection—the state’s official health insurance marketplace. It offers a wide range of ACA-compliant plans, many of which are eligible for subsidies and financial help based on your income and household size.

Here’s how to access low-cost health coverage in Maryland:

- Income-Based Subsidies: If your annual income falls within a certain range, you may qualify for premium tax credits that reduce your monthly payment.

- Cost-Sharing Reductions (CSRs): Available on Silver-tier plans, CSRs lower your out-of-pocket costs like deductibles and copayments.

- Young Adult & Catastrophic Plans: If you’re under 30 or meet hardship criteria, you may be eligible for low-premium catastrophic coverage.

- Medicaid & MCHP (Maryland Children’s Health Program): Those with very low income may qualify for free or nearly free health insurance through state-funded programs.

Most Marylanders who enroll through the marketplace receive some form of financial assistance. That’s why comparing plans during Open Enrollment is key to finding a plan that fits your budget without sacrificing coverage.

How to Compare Health Insurance Plans in Maryland

Choosing the right plan goes beyond just picking the lowest premium. To make an informed decision, it’s essential to compare health insurance in Maryland based on both cost and coverage.

Choosing the best health insurance in Maryland means comparing key plan elements:

| Factor | What to Look For | Why It Matters |

|---|---|---|

| Premiums vs. Deductibles | Balance between low monthly premiums and high deductibles (or vice versa) | Lower premiums often mean higher out-of-pocket costs when you need care |

| Coverage Details | Inclusions like preventive care, mental health, prescriptions, maternity, etc. | Ensures the plan covers your specific medical needs and services |

| Network Hospitals | Are your doctors and preferred hospitals in-network? | Out-of-network care can be more expensive or not covered at all |

| Plan Type (HMO, PPO, etc.) | Understand if you need referrals or if you can see specialists directly | Affects flexibility and ease of access to care |

| Out-of-Pocket Costs | Copays, coinsurance, and out-of-pocket maximums | These costs add up—important for budgeting, especially with frequent medical visits |

| Plan Comparison Tools | Use tools like Maryland Health Connection or AHiX Marketplace | Helps you compare options, estimate costs, and check for subsidies and financial help |

Open Enrollment and Special Enrollment Periods in Maryland

If you’re looking to enroll in the best health insurance in Maryland for 2025, understanding when and how to apply is essential. Whether you’re a first-time buyer or looking to update an existing plan, the enrollment period determines your eligibility to sign up, switch, or modify your coverage.

Open Enrollment Period for 2025

For most residents, the Maryland Health Connection the state’s official marketplace opens its Open Enrollment period from November 1, 2024, to January 15, 2025. During this time, you can:

- Sign up for health coverage in Maryland for the first time

- Change your existing health plan

- Update household or income details to adjust your financial assistance

If you do not take action within this window, you’ll need to wait until the next Open Enrollment unless you qualify for a Special Enrollment Period (SEP).

Special Enrollment: Qualifying Life Events

A Special Enrollment Period allows you to apply for Maryland health insurance outside the regular timeframe if you’ve experienced a qualifying life event. These events include:

- Loss of employer-sponsored insurance

- Marriage or divorce

- Birth or adoption of a child

- Moving to Maryland or changing your residence within the state

- Turning 26 and aging out of a parent’s policy

After one of these events, you typically have 60 days to select a new plan.

Why Enrollment Deadlines Matter

Missing the health insurance deadlines for 2025 can leave you without coverage or locked into a plan that no longer meets your needs. Reviewing your options early and enrolling on time ensures continuous care and helps you take advantage of any subsidies or financial help you’re eligible for.

Platforms like AHiX can assist with plan comparisons and enrollment, especially if you’re unsure whether you qualify for assistance or need help navigating the process.

Final Thoughts

Choosing the best health insurance in Maryland isn’t just about finding the lowest premium—it’s about ensuring your coverage meets your healthcare needs, fits your budget, and protects you and your family in 2025 and beyond. With expanded plan options, updated subsidies, and tools to simplify comparison shopping, Maryland residents have more power than ever to take control of their health coverage.

Whether you’re an individual, a parent, self-employed, or between jobs, the key is to evaluate your options during Open Enrollment, take advantage of available financial assistance, and use trusted platforms like AHiX Marketplace to explore and enroll in the plan that’s right for you.

By staying informed and proactive, you can confidently choose a plan that gives you access to the care you need—without overpaying for services you don’t. Now is the time to secure the coverage that supports your well-being and financial security.

FAQs:

1. Are there zero-premium health insurance plans available in Maryland?

Yes, some Maryland residents qualify for zero-premium plans, especially if they are eligible for enhanced subsidies or Medicaid. These are often available through the marketplace, depending on income and household size.

2. How do I know if my doctor accepts a specific Maryland health plan?

To check if your preferred doctor is in-network, visit the insurer’s provider directory or call the insurance company directly. It’s essential to verify this before enrolling to avoid unexpected out-of-pocket costs.

3. What is the difference between short-term and ACA health insurance in Maryland?

Short-term plans offer limited coverage for temporary needs and do not meet ACA standards. ACA-compliant plans provide comprehensive benefits and are available through the Maryland Health Connection, often with subsidies.

4. Can I switch my Maryland health insurance plan mid-year?

You can only switch plans mid-year if you qualify for a Special Enrollment Period due to a life event such as losing coverage, moving, or changing household status.

5. Is dental and vision insurance included in Maryland health plans?

Most standard health plans in Maryland do not include adult dental or vision coverage. However, many insurers offer these as add-ons or separate policies. Pediatric dental and vision are included in ACA-compliant family plans.

6. Can I get help choosing the best health insurance plan in Maryland?

Yes, you can speak with a licensed insurance agent, use the Maryland Health Connection comparison tool, or visit platforms like AHiX Marketplace to explore options and get expert guidance for free.

7. What documents do I need to apply for health insurance in Maryland?

Most of the time, documents aren’t required immediately unless you’re enrolling during a Special Enrollment Period (SEP), where you’ll need to confirm your Qualifying Life Event (QLE). Other documents may be requested later if there’s a Data Matching Issue (DMI), which happens when the details on your application don’t match federal or state records. If documents are needed, they typically include proof of income (like a pay stub or tax return), identification (driver’s license or state ID), and proof of Maryland residency (such as a utility bill or lease agreement).

8. How can I lower my health insurance premium in Maryland?

To reduce premiums, consider a Bronze-tier plan, increase your deductible, or verify your eligibility for tax credits. Updating your income and household details during enrollment can also help adjust your subsidy.