Breaking news — CVS has announced it will stop selling Obamacare plans in 2026, a major shakeup for the Affordable Care Act (ACA) market. This decision directly affects nearly one million Aetna CVS Health members who rely on individual health insurance through the ACA. As one of the largest providers leaves the individual market, many wonder how this will change their coverage options and costs under the Affordable Care Act 2026.

Let’s break down why Aetna CVS Health is making this move, who will be impacted, what this means for the future of ACA coverage, and the practical steps you should take now to secure affordable health insurance for 2026 and beyond.

Key Takeaways

- CVS to stop selling Obamacare plans in 2026, affecting around one million Aetna members nationwide.

- Aetna CVS Health is shifting its business strategy to manage rising healthcare costs.

- Affordable Care Act 2026 subsidies and tax credits could change, so it’s crucial to stay informed and compare your options.

Understanding the Affordable Care Act Exit

When CVS Health confirmed it would stop selling Obamacare plans in 2026, it signaled a significant shift in how major insurers are approaching the individual health insurance market. The Affordable Care Act 2026 still stands as the primary source of affordable individual coverage for millions of Americans — but big exits like this create uncertainty for members, states, and the insurance exchanges that rely on major carriers like Aetna CVS Health.

This exit means approximately one million people who currently have Aetna health insurance plans through the ACA will need to find new coverage. For families, individuals, and small business employees, understanding why this is happening can help them plan ahead and avoid gaps in their health insurance.

What’s Behind CVS Health’s Exit from Obamacare Plans?

Several factors have influenced CVS Health’s move to stop selling Obamacare plans in 2026 — let’s break down why this decision is happening now.

Why Is CVS to Stop Selling Obamacare Plans in 2026?

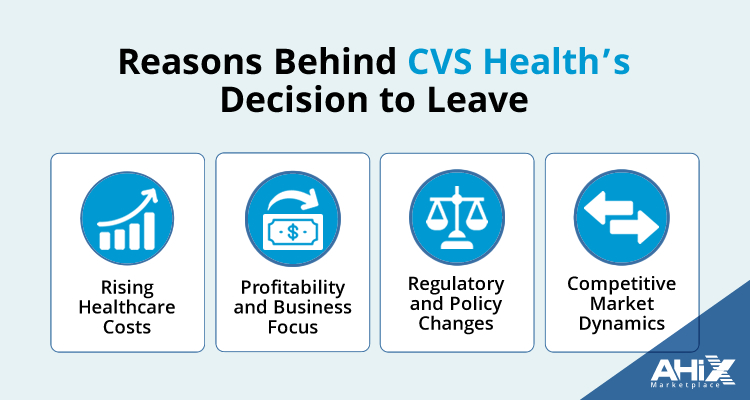

The decision to leave the individual ACA market wasn’t made overnight. Several factors are driving this strategic move:

Rising Healthcare Costs

Medical costs and claims continue to grow, putting pressure on insurance companies. The ACA individual market is known for tight margins, which makes it harder for insurers to balance affordable premiums with profitability.

Profitability and Business Focus

By exiting the Obamacare market, Aetna CVS Health can concentrate resources on higher-growth, more profitable segments — like pharmacy services, Medicare Advantage, pharmacy benefit management, and in-store health services.

Regulatory and Policy Changes

The ACA has faced years of regulatory changes, political uncertainty, and varying levels of government subsidies. Companies like CVS need to weigh how changing policies might affect future operations.

Competitive Market Dynamics

In some states, increased competition and smaller risk pools have made the individual ACA market less attractive for larger insurers that operate nationwide.

How CVS’s Exit Will Affect Aetna Members

About one million people with Aetna CVS Health ACA plans will need new coverage when CVS stops selling Obamacare plans in 2026. If you’re one of them:

- You must review plan options on the ACA exchanges well before open enrollment.

- Confirm if your preferred doctors and hospitals are in-network with new plans.

- Factor in potential changes to subsidies and premiums.

What Does This Mean for the Affordable Care Act in 2026?

Broader Effects on the ACA Market

CVS leaving the ACA individual market is a reminder that the Affordable Care Act 2026 landscape is always changing. Here’s what could shift:

- Fewer Choices in Some Areas: Fewer big insurers could mean limited plan options in some states.

- Possible Premium Changes: Fewer competitors may impact pricing.

- Policy Changes: Subsidies and tax credits could be revised depending on the political climate.

The Future of Individual Health Insurance After CVS’s Exit

When a major player like Aetna CVS Health decides to stop selling Obamacare plans in 2026, it highlights the ongoing challenges of the individual health insurance market. Many insurers are weighing how to balance rising healthcare costs with affordable premiums — and this shakeup could lead to fewer choices or shifting costs for consumers.

As the Affordable Care Act 2026 continues to evolve, Americans relying on individual coverage should pay close attention to plan options, network availability, and changing prices. With CVS Health leaving, comparing plans and staying informed will be key to protecting your coverage and budget.

Political Factors That Could Influence Obamacare Coverage

The political environment is a huge factor in the future of the Affordable Care Act 2026. Policy decisions around subsidies and tax credits will directly affect whether plans remain affordable for millions of families.

If subsidies are reduced or requirements change, the cost of individual health insurance could rise for many people who depend on the ACA exchanges. That’s why it’s so important for Aetna CVS Health members and anyone who buys individual plans to follow upcoming legislative changes closely.

Proactive research and using trusted resources — like independent comparison tools or advisors — can help you adjust quickly if policies shift.

Key Considerations for 2026

As 2026 approaches, it’s smart to prepare for CVS to stop selling Obamacare plans well in advance. Here are a few things to keep in mind:

Compare Plans Early

Look at ACA marketplace options in your area so you understand what’s available when open enrollment starts. Comparing medical insurance plans can be very simple when you know how to compare medical insurance plans.

Evaluate Your Healthcare Needs

Think about your family’s doctors, prescriptions, and coverage priorities — not just premiums.

Stay Informed

Keep up with policy updates that could change who qualifies for subsidies under the Affordable Care Act 2026.

Use Reliable Resources

Exploring trusted services that help you compare plans side by side can save you time, money, and stress. Many individuals use independent marketplaces like AHiX to confidently navigate the ACA marketplace and avoid surprises during enrollment.

By planning ahead, you’ll be ready to make the best choice for your health and your wallet.

Key Points to Remember

- Aetna CVS Health will stop selling Obamacare plans in 2026, leaving about a million members to find new coverage.

- The Affordable Care Act 2026 remains an important option for affordable individual health insurance, but the market may shift as big players exit.

- Stay informed, compare plans proactively, and use trusted marketplaces like AHiX to guide you through your options when open enrollment arrives.

Frequently Asked Questions

1. Why is CVS Health exiting the individual health insurance market?

CVS Health is exiting to streamline operations and focus on more profitable healthcare solutions, addressing rising costs effectively.

2. How will Aetna members be affected by this decision?

Approximately one million Aetna members will need to find new health insurance plans on the ACA exchanges by 2026.

3. What should Aetna members do to prepare for 2026?

Members should start reviewing available plans on the ACA exchanges and consider their healthcare needs to find suitable alternatives.

4. Will Obamacare subsidies continue in the future?

The continuation of subsidies is uncertain and depends on future political decisions regarding the Affordable Care Act.

5. Where can I find more information about individual health insurance options?

Visit AHiX’s individual health insurance page for detailed information on available plans and resources.

6. What does CVS’s decision to stop selling Obamacare plans in 2026 mean for my premiums?

Fewer insurers in your area could mean less competition and potentially higher premiums in 2026. With one less carrier, plan choices may be limited, so it’s smart to compare rates and network options early.

7. Will the Affordable Care Act 2026 still offer affordable individual coverage?

Yes — despite CVS Health’s exit, the Affordable Care Act 2026 will continue to offer individual and family plans through federal and state exchanges. Options and costs may vary by location.

8. Can I keep my current doctors if CVS stops selling Obamacare plans?

You’ll need to check each new ACA plan’s network to confirm if your preferred doctors and hospitals are included.

9. When should I start shopping for a new ACA plan if I’m an Aetna CVS Health member?

Start comparing plans as soon as open enrollment begins (Nov 1st) for 2026. Many people use trusted platforms like AHiX to review plan options early and avoid last-minute stress.

10 Who can help me compare Affordable Care Act 2026 plans easily?

You can use official ACA exchanges, licensed agents, or independent resources like AHiX to compare other health insurance plans side by side, understand costs, and find the right fit for your family.

Final Thoughts & Next Steps

Major exits like CVS Health’s remind us that the ACA market can change fast, but you can stay prepared.

Compare your options, watch for policy updates, and use trusted marketplaces like AHiX to keep your family covered and your costs under control.