Health insurance is no longer just a concern for full-time employees. With more people working reduced hours, freelancing, or balancing multiple jobs, the demand for part-time employee health insurance has grown rapidly. Yet, finding the right coverage in 2025 can feel confusing, as employer rules, state regulations, and plan options all play a role.

The reality is simple: most part-time workers do not automatically receive health benefits from their employer. However, that doesn’t mean affordable coverage is out of reach. Between ACA Marketplace plans, Medicaid, short-term medical coverage, and private options, part-time employees today have more choices than ever before.

In this guide, we’ll explain what counts as part-time under insurance rules, explore your main health insurance options, break down costs, and share how AHiX Marketplace makes it easier to compare plans side by side.

Do Employers Offer Health Insurance for Part-Time Workers?

One of the first questions part-time employees ask is whether their job will include health insurance. The answer depends on your employer, your hours, and federal guidelines.

Employer Rules Under the ACA

The Affordable Care Act (ACA) requires companies with 50 or more full-time employees to provide health insurance. A “full-time” worker is defined as someone averaging 30 or more hours per week. Employees working fewer hours fall into the part-time category and are not guaranteed benefits under federal law.

Employer Discretion

Some companies, especially in retail, healthcare, or education, voluntarily offer part-time employee health insurance to attract and retain talent. These plans often come with stricter eligibility requirements, such as:

- Working a minimum number of weekly hours (e.g., 20–29 hours)

- Completing a probationary period before coverage begins

- Paying a higher share of monthly premiums compared to full-time staff

Industries Where Benefits Are Rare

Many part-time jobs in hospitality, food service, and the gig economy do not provide traditional health benefits. For these workers, exploring Marketplace health insurance, Medicaid, or short-term coverage becomes essential.

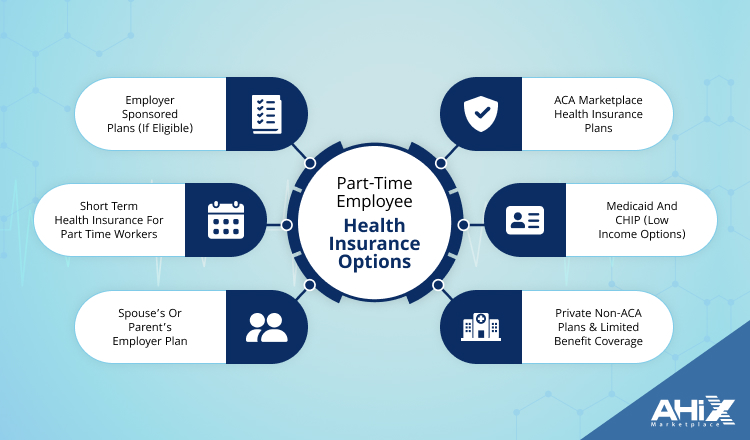

Part-Time Employee Health Insurance Options in 2025

Even if your employer doesn’t offer benefits, you still have several ways to get covered. The right option depends on your income, hours worked, and family needs. Here are the main choices for part-time employee health insurance in 2025:

1. Employer-Sponsored Plans (If Eligible)

Some employers extend group health coverage to part-time workers, though it’s not required by law. These plans usually:

- Have higher employee premium contributions than full-time plans

- Require a minimum number of weekly hours

- May offer fewer benefit choices

For those who qualify, this can still be the most affordable option since employers often cover part of the premium.

2. ACA Marketplace Health Insurance Plans

The Health Insurance Marketplace is a top option for part-time workers without employer coverage. Benefits include:

- Subsidies: Premium Tax Credits lower monthly costs based on income.

- Essential health benefits: Preventive care, prescriptions, and hospital coverage are all included.

- Flexibility: You can compare plans with different networks and price points.

Part-time employees with variable income often qualify for subsidies, making ACA plans one of the best long-term solutions.

3. Short-Term Health Insurance for Part-Time Workers

Short-term health plans are a budget-friendly alternative when you need coverage quickly. In 2025, new CMS rules will allow some plans to last longer than the previous three-month limit. Key points:

- Lower monthly premiums compared to ACA plans

- Limited coverage usually excludes pre-existing conditions

- Best for temporary jobs, coverage gaps, or healthy individuals

4. Medicaid and CHIP (Low-Income Options)

For part-time employees earning below certain income levels, Medicaid may provide free or low-cost coverage. Children in part-time families may also qualify for CHIP (Children’s Health Insurance Program). Eligibility varies by state, but these options remain essential safety nets.

5. Spouse’s or Parent’s Employer Plan

Many part-time workers gain coverage as a dependent under a spouse’s or parent’s plan. While premiums may be higher than individual policies, this option often offers comprehensive benefits with lower deductibles.

6. Private Non-ACA Plans & Limited-Benefit Coverage

Some workers choose private health plans that are not ACA-compliant. These may include:

- Fixed indemnity plans that pay set amounts per service

- Supplemental dental or vision insurance

- Accident or critical illness coverage

These are not full replacements for major health coverage but can reduce out-of-pocket costs.

How Much Does Part-Time Employee Health Insurance Cost in 2025?

Understanding the cost of health insurance is essential if you’re a part-time worker shopping for coverage. Your expenses will depend heavily on the type of plan, how many hours you work, whether you qualify for subsidies, and your income. Here’s a breakdown of what to expect in 2025.

Affordable Care Act (ACA) Marketplace Plan Costs

- Premium Tax Credits / Subsidies: If your income is under a certain threshold, federal or state subsidies can significantly lower your monthly cost for ACA plans. This makes ACA Marketplace coverage a popular choice for part-time employees.

- Affordability Threshold: For 2025, the ACA affordability rate is 9.02% of your household income. If the plan you’re offered (or choose) costs more than that for employee-only coverage, you may be eligible for subsidies.

- Safe Harbor Amount: One “safe harbor” guideline says that if an individual plan costs no more than $113.20 per month for self-only coverage, it meets the affordability requirement under the Federal Poverty Line (FPL) for 2025.

Employer-Sponsored Plan Costs (If Available for Part-Timers)

Even when employers offer health insurance to part-time staff, costs tend to be higher per person, because part-time employees usually pay a larger share of premiums and/or have less generous benefits.

- According to recent surveys, single (employee-only) employer-sponsored plan premiums average around $8,900/year (≈ $740/month) or more. The employee’s share of that might be 10-20%, depending on contribution levels, so expect $150-$300+/month for part-time employees who are offered a plan.

- Family coverage costs significantly more, often several thousand dollars annually. Part-time employees who need family coverage should expect steeper premiums and likely higher out-of-pocket costs.

Out-of-Pocket Costs: Deductibles, Copays, and Coinsurance

Premiums are just one part of the cost. Even with a plan, you’ll have to pay:

- Deductibles: The amount you pay before insurance starts paying

- Copays/co-insurance: Small fixed fees per visit or a percentage of service cost

- Maximum Out-of-Pocket (MOOP): The cap on how much you must pay per year (including deductible + coinsurance + copays) before the plan covers 100%. For ACA plans, MOOP for individuals in 2025 tends to hover in the thousands.

These expenses can push total annual costs for part-time employees into the $2,000-$6,000+ range (or more) for moderate plans, depending on how often you use medical services.

Short-Term & Private Plan Costs

If a part-time employee uses a short-term health insurance plan or a limited benefit/private non-ACA plan:

- The monthly premium may be significantly lower than ACA plans, sometimes half or less, especially for younger, healthy adults.

- However, many short-term plans exclude pre-existing conditions and provide limited to no coverage for maternity, mental health, and substance abuse.

- These plans can be useful during coverage gaps.

Cost Variation by State, Age, and Usage

- Where you live matters: Premiums in high-cost states are substantially higher. Providers, state regulations, and network availability all influence cost.

- Age & health status: Older individuals or those with pre-existing conditions may pay more.

- How much care you expect to use: If you have frequent doctor visits, need specialist care, or have ongoing treatment, you should budget more for copays and coinsurance.

Sample Cost Scenarios for Part-Time Workers

Here are illustrative scenarios to help estimate what you might pay monthly:

| Scenario | Age | Income Level | Plan Type | Estimated Premium (Self-Only) | Estimated Out-of-Pocket Costs |

|---|---|---|---|---|---|

| Young, Healthy, Low Income | 25 | ~150% FPL | ACA Silver with subsidy | $50–$150 / month | Deductible ~$1,500 + copays |

| Mid-aged, Moderate Income | 45 | 250% FPL | ACA Gold or Employer-Sponsored | $300–$600 / month | Deductible ~$1,000–$2,500, moderate coinsurance |

| Older, High Utilizer | 60 | 400% FPL | ACA Platinum or Full Employer Plan | $600–$1,200+ / month | Deductible lower, MOOP high, frequent visits |

*Estimates vary by plan, state, and how much medical care you use. These are not guarantees but serve to help with budgeting.

Pros and Cons of Each Coverage Options

Choosing the right part-time employee health insurance requires weighing costs, benefits, and eligibility. Here’s a side-by-side look at the main options available in 2025:

| Coverage Option | Pros | Cons | Best For |

|---|---|---|---|

| Employer-Sponsored Insurance (if offered) | Lower group rates, employer pays part of the premium, comprehensive coverage | Limited availability for part-timers, stricter eligibility rules, higher worker share of cost | Part-time employees at large companies or unions |

| ACA Marketplace Plans | Subsidies can lower premiums, essential health benefits included, wide plan choices | Without subsidies, premiums can be high; limited enrollment windows | Part-time workers with low-to-moderate incomes |

| Short-Term Health Insurance | Low monthly premiums, flexible start dates, and quick approval | Excludes pre-existing conditions, no coverage for maternity, mental health, or substance abuse | Healthy part-time workers needing temporary coverage |

| Medicaid / CHIP | Very low or no cost, broad coverage including preventive and hospital care | Strict income limits, eligibility varies by state | Low-income part-time workers and families with children |

| Spouse’s or Parent’s Employer Plan | Comprehensive benefits, typically lower deductibles | May increase family premium costs, dependent rules apply | Workers with access through spouse or parent |

| Private Non-ACA / Supplemental Plans | Can fill gaps (dental, vision, accident), flexible purchase anytime | Not full major medical coverage, limited benefits | Workers needing extra protection beyond core health plan |

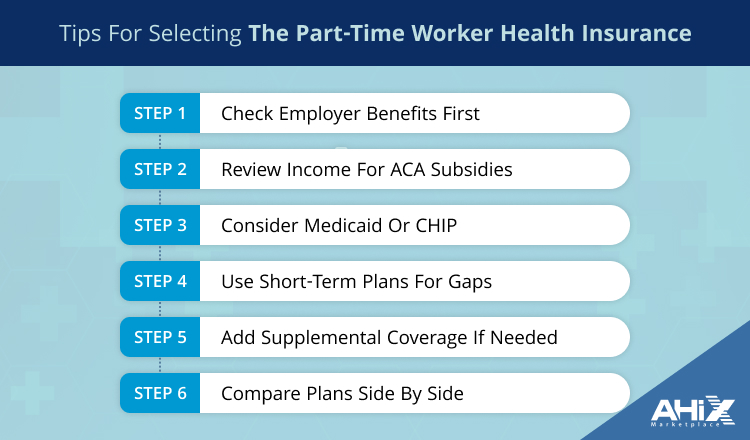

How to Choose the Best Health Insurance as a Part-Time Worker?

With so many options, selecting the right part-time employee health insurance can feel overwhelming. The best approach is to match your health needs and budget with the type of coverage available.

Step 1: Check Employer Benefits First

- Ask HR if your company offers health insurance to part-time staff.

- Confirm eligibility requirements (minimum hours, waiting periods, premium share).

- Compare costs against Marketplace plans, sometimes employer options are cheaper, but not always.

Step 2: Review Income for ACA Subsidies

- If your employer does not offer coverage, explore the ACA Marketplace.

- Use your estimated annual income to see if you qualify for Premium Tax Credits or Cost-Sharing Reductions.

- Subsidies can lower both monthly premiums and out-of-pocket expenses.

Step 3: Consider Medicaid or CHIP

- If your income is below your state’s threshold, Medicaid or CHIP may provide free or low-cost coverage.

- Eligibility is often higher for families with children or pregnant women.

Step 4: Use Short-Term Plans for Gaps

- If you only need temporary coverage between jobs or while waiting for benefits to start, short-term health insurance can bridge the gap.

- Just remember, these plans are not a substitute for long-term, comprehensive care.

Step 5: Add Supplemental Coverage if Needed

- Consider dental, vision, or accident insurance to fill coverage gaps.

- Many part-time employees combine a basic health plan with supplemental coverage for complete protection.

Step 6: Compare Plans Side by Side

- Look at premiums, deductibles, provider networks, and prescription coverage.

- Don’t focus only on monthly premiums — consider how much you’d pay if you needed regular care.

- Use a platform like AHiX Marketplace to quickly compare multiple options in one place.

Why AHiX Marketplace is the Smart Choice for Part-Time Workers

Finding part-time employee health insurance doesn’t have to be complicated. The challenge is that options vary widely by state, income, and employer, making it hard to know which plan truly fits your needs. That’s where AHiX Marketplace makes the difference.

With AHiX, you can:

- Compare over 600 plans from more than 270 insurance companies in one place

- See your subsidy eligibility instantly to lower monthly costs on ACA Marketplace plans

- Shop affordable options, with plans starting at just $8.95 per month

- Add dental and vision coverage easily, so you don’t need to manage separate providers

- Get expert help from licensed agents, who can guide you through choosing the right plan based on your income, hours worked, and family situation.

For part-time workers who want peace of mind without overpaying, AHiX is a one-stop solution that simplifies the process from comparing quotes to enrolling in coverage.

Final Verdict: Do Part-Time Employees Have Good Health Insurance Options in 2025?

The truth is, part-time employee health insurance isn’t always straightforward. Employers aren’t required to cover part-time staff, and many don’t. But that doesn’t mean you’re left without choices. From ACA Marketplace plans with subsidies, to short-term medical coverage, Medicaid, or even joining a spouse’s plan, there are practical paths to protect your health in 2025.

The key is knowing your options and comparing costs carefully. If your employer offers coverage, review it first. If not, ACA subsidies or Medicaid could make coverage surprisingly affordable. And for temporary needs, short-term plans or supplemental coverage may fill the gap.

At AHiX Marketplace, we make the process easier. With hundreds of plans from leading insurers, personalized support from licensed agents, and affordable options starting at $8.95 a month, finding health insurance as a part-time worker has never been more accessible.

Don’t wait until you’re uninsured or facing high medical bills. Explore your health insurance options today and secure a plan that fits your schedule, your budget, and your life.

FAQs:

1. Do part-time employees get health insurance in 2025?

Most part-time workers are not guaranteed employer coverage. However, options include ACA Marketplace plans, Medicaid, short-term health insurance, or joining a spouse’s plan.

2. What is the cheapest health insurance for part-time workers?

The most affordable plans often come from the ACA Marketplace with subsidies or from Medicaid if you qualify. Some AHiX dental plans also start at $8.95 per month.

3. Can part-time employees qualify for ACA subsidies?

Yes. If your household income falls within the ACA subsidy limits, you can receive Premium Tax Credits that reduce monthly premiums. This applies even if you work part-time.

4. Does short-term health insurance cover part-time employees?

Yes. Short-term health insurance is available to part-time workers and offers low monthly premiums. However, it typically excludes pre-existing conditions and is not a long-term coverage option.

5. Can part-time workers get health insurance through Medicaid or CHIP?

Yes. If your income is low enough, you may qualify for Medicaid. Children in part-time households may be eligible for CHIP, which provides free or low-cost coverage.

6. How much does health insurance cost for part-time employees in 2025?

Costs vary. ACA plans with subsidies may be under $150 per month, while unsubsidized or employer plans can range from $300 to $600+ per month, depending on coverage.

7. How many hours do you have to work to get health insurance as a part-time employee?

Under the Affordable Care Act, employees working 30 hours or more per week are considered full-time and must be offered insurance by large employers. Part-time workers under 30 hours are not guaranteed coverage, though some employers may offer it voluntarily.

8. Can part-time employees get employer health benefits?

Yes, but it depends on the company. Some employers in industries such as retail or education offer part-time employees health insurance, often requiring a minimum of 20–29 hours per week. Coverage is not legally required.

9. What are the best health insurance options for part-time workers in 2025?

Top options include ACA Marketplace plans with subsidies, Medicaid for low-income workers, short-term health insurance for gaps, and joining a spouse’s or parent’s plan.

10. Can I stay on my parents’ insurance if I work part-time?

Yes. Under current rules, you can remain on a parent’s employer-sponsored or Marketplace health plan until age 26, regardless of your employment status.

11. Are dental and vision plans available for part-time workers?

Yes. Many part-time employees purchase separate dental and vision insurance. Through AHiX, plans start at just $8.95 per month, making them affordable add-ons.

12. Do part-time employees pay more for health insurance?

Usually, yes. If an employer offers coverage, part-time employees often pay a higher percentage of premiums compared to full-time staff. Marketplace subsidies may help offset these costs.

13. Can part-time employees use HSAs or FSAs for health expenses?

If you enroll in a qualifying high-deductible health plan (HDHP), you may be eligible for an HSA. FSAs depend on whether your employer offers them. Both accounts allow you to pay medical expenses with pre-tax dollars.

14. What is the difference between ACA Marketplace insurance and short-term health insurance for part-time workers?

ACA Marketplace insurance covers essential health benefits, pre-existing conditions, and preventive care. Short-term health insurance is cheaper but excludes pre-existing conditions and offers limited coverage.

15. How can part-time employees find affordable health insurance quickly?

You can compare ACA, short-term, and private plans through AHiX Marketplace. The platform shows subsidy eligibility, costs, and coverage options in minutes.