When it comes to protecting your health and finances, health insurance is one of the most important investments you can make. But one question comes up again and again: “How much is the average health insurance cost per month?”

In 2025, the numbers show that individuals spend an average of $440 per month, while families pay around $1,168 per month for coverage. These costs can vary widely depending on factors like age, location, tobacco use, and the type of plan you choose.

For many households, these monthly premiums can feel overwhelming. That’s why it’s so important to understand what drives these costs and how you can find a plan that balances affordability with reliable coverage.

At AHiX, we simplify the process by helping you compare plans from top carriers in one place. Whether you’re shopping for yourself or your family, this guide breaks down the average monthly health insurance premiums you can expect, the factors that affect them, and tips to save money on your coverage.

What Is the Average Health Insurance Cost per Month?

When we talk about the average health insurance cost per month, we’re really looking at what most Americans pay in premiums for coverage. In 2025, individuals spend an average of $440 per month, while families pay around $1,168 per month. These figures are based on marketplace and employer-sponsored plans and provide a baseline for what you can expect.

It’s important to understand that this “average” is not a one-size-fits-all number. Premiums vary depending on the type of plan you select, whether you qualify for subsidies, and the benefits included in your policy. For example, all Affordable Care Act (ACA) compliant plans must cover essential services such as:

- Doctor visits

- Prescription drugs

- Hospital care

- Preventive services

- Mental health treatment

This means that while premiums may feel high, they come with a guaranteed level of coverage. Still, costs can differ significantly across states and family sizes, which is why looking at individual vs. family plans separately is so important.

Average Health Insurance Cost per Month for Individuals

For individuals, the average health insurance cost per month in 2025 is about $440. This figure, however, is only a starting point. Your actual premium may be higher or lower depending on a few key factors.

- Age: Younger adults generally pay less, while older adults may see premiums climb due to greater healthcare needs.

- Location: Costs differ by state and even within regions. For example, a single person in a high-cost state like Wyoming may pay much more than someone in a southern state with lower average premiums.

- Plan Type: Bronze plans usually offer the lowest monthly cost but come with higher out-of-pocket expenses. Gold or Platinum plans cost more each month but cover a greater share of medical bills.

- Subsidies: Many individuals qualify for tax credits under the Affordable Care Act (ACA), which can significantly reduce monthly premiums.

For healthy adults with minimal medical needs, a Bronze or Silver plan is often a more affordable choice. But if you expect regular doctor visits or ongoing prescriptions, paying a bit more each month for broader coverage may save you money in the long run.

Average Health Insurance Cost per Month for Families

For families, the average health insurance cost per month in 2025 is about $1,168. This amount reflects coverage for two adults and their dependents, though actual premiums can vary based on family size, state regulations, and the specific plan selected.

Unlike individual coverage, family health insurance must account for multiple people’s medical needs. A single plan typically covers:

- The policyholder

- A spouse or partner

- Dependent children

The more dependents you add, the higher the premium will be. Some households find that a single family plan is the most cost-effective option, while others may save money by combining separate individual plans, depending on subsidy eligibility and health needs.

Employer-sponsored family plans are often less expensive than marketplace plans because many employers share part of the premium. However, families without access to employer coverage may rely on marketplace plans and can lower costs through ACA subsidies if their income qualifies.

For households with children, it’s especially important to balance monthly premium costs with out-of-pocket expenses, since kids often require frequent checkups, vaccinations, or specialist visits. Choosing the right plan ensures families stay protected without overspending.

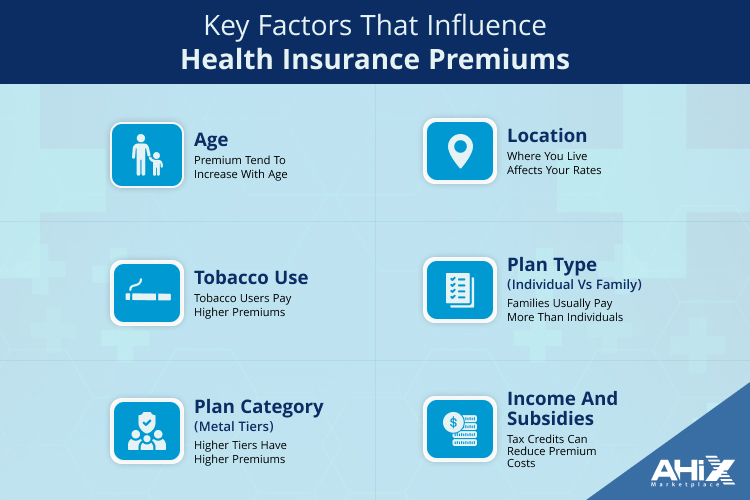

Factors That Affect Monthly Health Insurance Premiums

While national averages give a starting point, your actual monthly health insurance premium depends on several personal and regional factors. Here are the most important ones:

1. Age

Premiums usually rise with age. Younger adults often pay the lowest rates, while older adults pay more due to greater healthcare needs.

2. Location

Where you live plays a major role. States with a higher cost of living or stricter insurance regulations typically have higher premiums. For instance, premiums in California or New Jersey are often higher than those in states like Alabama or Kentucky.

3. Tobacco Use

Smokers and tobacco users can be charged up to 50% more than non-smokers, as insurers account for higher health risks linked to tobacco use.

4. Plan Type (Individual vs. Family)

A single individual will generally pay less than a family. Adding dependents to a policy increases the monthly cost.

5. Plan Category (Metal Tiers)

The ACA marketplace organizes plans into Bronze, Silver, Gold, and Platinum tiers.

- Bronze = lowest premiums, highest out-of-pocket costs.

- Platinum = highest premiums, lowest out-of-pocket costs.

6. Income and Subsidies

Households with moderate incomes may qualify for premium tax credits that lower monthly costs, especially for Silver plans.

Understanding these factors is essential before choosing a plan, since each can significantly impact your monthly premium.

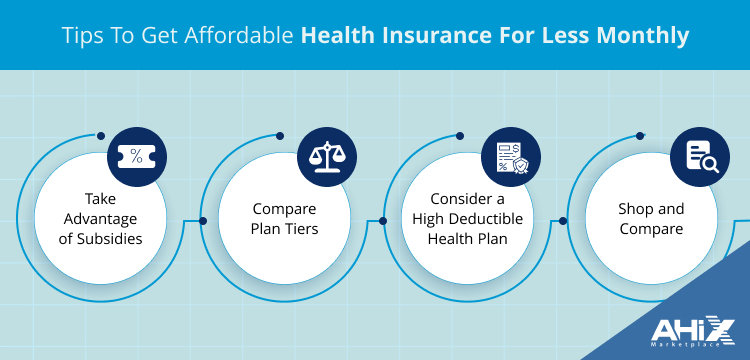

Affordable Health Insurance Cost per Month: How to Save

Even though the average health insurance cost per month may seem high, there are several ways to make coverage more affordable. The key is knowing which options apply to your situation.

1. Take Advantage of Subsidies

If you purchase insurance through the ACA marketplace, you may qualify for premium tax credits based on income. These subsidies can lower monthly premiums significantly.

2. Compare Plan Tiers

Choosing the right metal tier matters. Bronze and Silver plans often have lower premiums, though they come with higher out-of-pocket costs. For healthy individuals or families with minimal medical needs, these can be cost-effective.

3. Consider a High-Deductible Health Plan (HDHP)

HDHPs paired with a Health Savings Account (HSA) allow you to save pre-tax dollars for medical expenses. While monthly premiums are lower, this works best if you don’t expect frequent medical visits.

4. Shop and Compare

Premiums vary by insurer, even within the same state. Comparing multiple carriers before enrolling ensures you’re not overpaying for similar coverage.

By carefully reviewing your options and considering subsidies, plan tiers, and HSAs, you can reduce your monthly premium without sacrificing essential coverage.

Health Insurance Cost Comparisons by State & Plan Type

One of the biggest reasons health insurance premiums vary so much is where you live. Each state sets its own rules for insurers, and regional healthcare costs play a role in pricing. For example, states with higher medical expenses or stricter coverage mandates generally have higher premiums.

At the same time, the plan tier you choose also affects your monthly cost. Bronze plans typically have the lowest premiums, while Platinum plans charge the most but cover a larger share of healthcare expenses.

Here’s a snapshot of how premiums can differ:

| Plan Type (2025 Average) | Monthly Premium (Individual) | Monthly Premium (Family of 4) |

|---|---|---|

| Bronze | $360 | $950 |

| Silver | $440 | $1,168 |

| Gold | $520 | $1,340 |

| Platinum | $600+ | $1,500+ |

State-level differences are just as striking. For example, Wyoming and Alaska often rank among the most expensive states for premiums, while states like Alabama or Kentucky tend to have lower averages.

This variation is why it’s important to compare both plan tiers and state-level averages before deciding.

Conclusion

Understanding the average health insurance cost per month is the first step in making a smart choice for yourself or your family. In 2025, individuals can expect to pay around $440 per month, while families average $1,168 per month. These numbers, however, are only guidelines; your actual premium depends on factors like age, state, tobacco use, and plan type.

The most important takeaway is that health insurance is not just about the monthly premium. Deductibles, out-of-pocket costs, and coverage levels all play a role in your total yearly expense. That’s why it pays to compare options carefully before enrolling.

With tools like AHiX, you can view multiple plans side by side, find out if you qualify for subsidies, and choose coverage that balances affordability and protection for your unique situation.

FAQs:

1. How much does health insurance cost without a job?

If you’re unemployed, your options include COBRA coverage, marketplace plans, or government programs like Medicaid. On the marketplace, monthly premiums can range from $300 to $600 for individuals, though subsidies may lower this cost if your income is reduced. Medicaid is often free or very low-cost if you qualify.

2. How much does health insurance cost in California?

In California, the average individual premium is around $450 per month, while family coverage averages over $1,200 per month. Costs vary by plan tier and income level. California also requires residents to have health insurance or pay a state penalty, making it important to compare plans carefully.

3. Does health insurance cover ambulance costs?

Most health insurance plans do cover ambulance services, but coverage details vary. Some plans may fully cover emergency ambulance rides, while others require you to pay part of the bill through deductibles or co-pays. Always check your plan’s emergency services section to confirm.

4. Can I deduct health insurance costs from my taxes?

Yes, in some cases. Self-employed individuals can deduct 100% of their premiums from taxable income. For others, medical expenses (including premiums) are deductible only if they exceed 7.5% of your adjusted gross income (AGI) and you itemize deductions.

5. How much does health insurance cost for a family of 4?

On average, a family of four pays around $1,200 to $1,400 per month for coverage in 2025. The exact cost depends on location, age of family members, and the plan type. Subsidies can help reduce these costs if the household qualifies.

6. What’s the cheapest type of health insurance plan?

Typically, Bronze plans have the lowest monthly premiums. However, they come with higher deductibles and out-of-pocket costs when you need care. They’re best for people who don’t expect frequent medical visits.

7. How does health insurance cost differ for students or part-time workers?

Students and part-time workers often qualify for lower-cost options, such as staying on a parent’s plan, using school-sponsored coverage, or applying for subsidies through the marketplace. Medicaid may also be available depending on income.

6. Can I change my health insurance plan if the cost is too high?

Yes. You can switch plans during the Open Enrollment Period, or if you qualify for a Special Enrollment Period due to life events such as marriage, birth of a child, or losing other coverage.

7. Does health insurance cost less for healthy people?

Indirectly, yes. While ACA rules prevent insurers from charging more for preexisting conditions, younger and healthier people often choose lower-tier plans (like Bronze), which means they pay less in monthly premiums compared to older adults.

8. How are health insurance premiums calculated?

Insurance companies base premiums on factors like your age, location, plan tier, tobacco usage, and whether the plan covers an individual or family. States with higher healthcare costs generally have higher premiums, while younger or healthier individuals typically pay less.

9. Does health insurance cost the same in every state?

No. Premiums vary widely by state due to differences in healthcare costs, regulations, and competition among insurers. States like Alaska and Wyoming often have higher premiums, while southern states typically see lower averages.

10. Can self-employed people get affordable health insurance?

Yes. Self-employed individuals can buy plans through the ACA marketplace and may qualify for subsidies. Premiums can also be tax-deductible, which reduces overall costs.