Choosing the right emergency health care insurance for your family is one of the most important decisions you can make. Emergencies can happen at any time, whether it’s a sudden illness, an unexpected injury, or an accident. Having the right health insurance coverage ensures that you’re protected in these critical moments without facing high medical bills. The key is to find a balance between affordable premiums and sufficient coverage that meets your family’s needs.

At AHiX Marketplace, we understand that finding the best insurance just for emergencies can be overwhelming, but we’re here to help you navigate your options. Lets walk you through the steps to help you choose the best emergency health insurance plan for your family, ensuring that you’re covered when the unexpected happens.

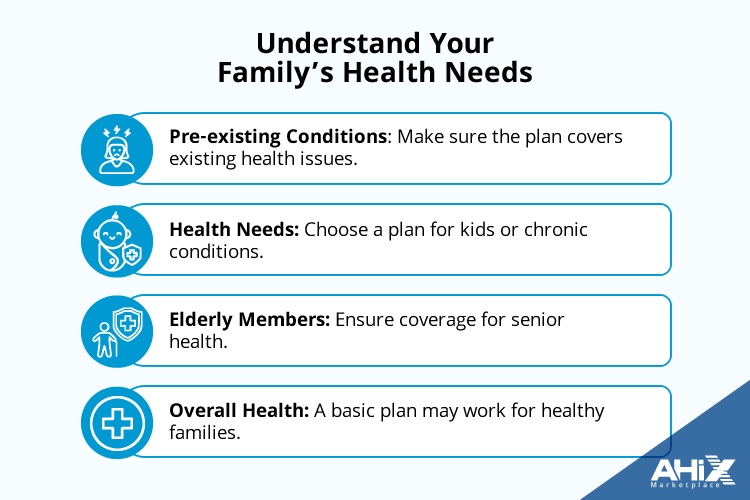

1. Understand Your Family’s Health Needs

When selecting an emergency health insurance plan, it’s important to take a close look at your family’s health needs. Here are some key factors to consider:

Pre-existing conditions:

Does anyone in your family have any existing medical conditions, such as diabetes, asthma, or heart disease, that might require emergency care? If so, you’ll need a plan that offers sufficient coverage for these conditions in emergencies.

Specific health needs:

Are you looking for coverage for pediatric care (for children) or coverage for chronic illnesses (like arthritis, hypertension, or other long-term conditions)? If your family requires special care for certain health needs, make sure your emergency health care insurance plan covers those conditions.

Elderly family members:

If your family includes elderly members, they may need more frequent medical attention. Consider plans that offer coverage for senior health care, including emergencies that may arise from age-related conditions.

Overall health needs:

Is your family generally healthy, or are there other chronic issues to consider? If your family is healthy but wants to be covered for unexpected emergencies, a basic emergency health care coverage plan might suffice.

Once you have a clear picture of your family’s needs, you can determine whether you require a comprehensive health insurance plan or a simpler, more affordable emergency health care insurance plan. At AHiX, we offer various options that cater to different health situations, ensuring that your family is protected in case of an emergency.

2. Choose Between Qualified and Non-Qualified Plans

When selecting emergency health care insurance, it’s essential to understand the difference between qualified health plans and non-qualified plans.

Qualified Health Plans:

These plans are compliant with the Affordable Care Act (ACA) and cover essential benefits, including emergency health care insurance. ACA-compliant plans are more comprehensive, offering coverage for a range of medical needs, including preventive care and essential health benefits. They tend to come with higher premiums but provide more extensive coverage for your family’s health needs.

Non-Qualified Plans:

These plans are often cheaper but do not meet ACA standards. They might cover emergency health care insurance needs, but may exclude some essential services like maternity care, mental health care, and prescriptions. If your priority is health insurance just for emergencies, these plans could be an affordable option, especially if you only need basic coverage.

Choosing between these plans depends on your budget and how much coverage you want. AHiX makes it easy to compare both types of plans so that you can make the best choice for your family.

3. Look for Affordable Premiums and Deductibles

Cost is often one of the biggest considerations when choosing an emergency health care insurance plan. Premiums (the monthly cost of the insurance) and deductibles (the amount you pay out-of-pocket before your insurance kicks in) can vary significantly between plans. Here’s what to keep in mind:

Premiums:

ACA-compliant plans usually have higher premiums but offer better coverage for emergency health insurance. Non-qualified plans typically have lower premiums, but they might come with higher out-of-pocket costs for emergency care.

Deductibles:

High deductible health plans (HDHPs) offer lower premiums but require you to pay more out of pocket before your insurance starts covering costs. If your family’s health is generally stable, an HDHP could help lower your monthly costs while still providing emergency health care coverage in case of a medical crisis.

At AHiX Marketplace, you can explore a variety of plans with different premium and deductible options, helping you find the plan that fits your budget while providing essential health insurance emergency coverage.

4. Ensure Your Plan Includes Emergency Health Care Insurance Coverage

When looking for emergency health insurance, make sure the plan you choose includes coverage for emergency services. Not all health insurance plans cover the same range of emergency care, and some plans may have limitations or exclusions when it comes to emergency room visits, ambulance services, and urgent care.

Look for plans that cover:

- Emergency room visits: These are essential for treating serious injuries or sudden illnesses.

- Ambulance transportation: This ensures that you’re covered for emergency transport to the hospital if needed.

- Hospital stays: In case of hospitalization due to an emergency, it’s important that your insurance plan provides coverage for inpatient care.

Whether you choose a qualified or non-qualified plan, be sure that it provides robust coverage for emergency care, including these critical services.

5. Consider Family Health Insurance Plans

If you’re looking to cover your entire family, consider choosing a family health insurance plan that includes emergency health care insurance. Family health insurance plans are typically more affordable per person than individual plans, especially if you qualify for subsidies.

A family plan can also simplify managing your coverage, as all members will be included under one policy. At AHiX Marketplace, we offer a range of family health insurance plans that cover emergency medical services for all members of the household, including children and elderly family members.

By choosing a family plan with emergency health care coverage, you can ensure that everyone in your household is protected in case of an unexpected medical situation.

6. Review Your Network of Providers

Having access to a wide network of health care providers is crucial when you need emergency health insurance. When comparing different plans, make sure that your preferred doctors, hospitals, and urgent care centers are included in the plan’s network.

In-network care:

With in-network coverage, you’ll typically pay less for services. It’s especially important to check that emergency health services are available at nearby in-network facilities.

Out-of-network care:

Be aware that seeking emergency services outside of the network can lead to higher costs. Some plans offer out-of-network emergency coverage, but it’s important to understand the potential cost difference.

At AHiX Marketplace, we provide plans with extensive networks of emergency health care providers, ensuring you can get the care you need quickly and affordably.

7. Check for Additional Coverage Options (Dental, Vision, etc.)

While emergency health care insurance is essential, it’s also worth considering additional coverage options for your family. Many health insurance plans offer dental and vision coverage in addition to medical care, which can be crucial in emergencies.

For example, dental emergencies, such as a broken tooth from an accident, or vision issues that require urgent attention, may not be fully covered under a basic emergency plan. Look for plans that offer additional benefits like dental and vision coverage to ensure your family is fully covered for unexpected medical situations.

AHiX Marketplace offers various plans that include dental health insurance, in addition to comprehensive emergency health care insurance coverage.

8. Explore Subsidies and Financial Assistance

If your family’s income is on the lower end, you may be eligible for subsidies that can help make emergency health care insurance more affordable. Through the Health Insurance Marketplace, individuals and families with qualifying income can receive financial assistance to lower their monthly premiums. This can make ACA-compliant health plans much more affordable.

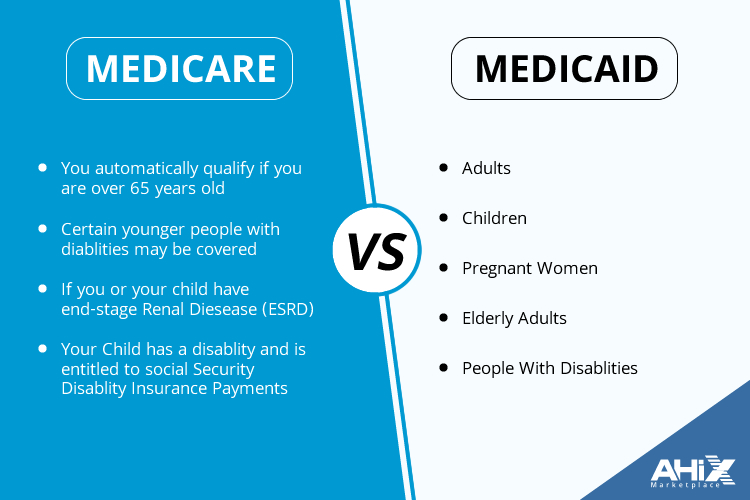

Additionally, Medicaid may be available for low-income families, providing emergency health care coverage with little to no cost. Eligibility for Medicaid is based on income and family size, and it covers a wide range of people, including adults, children, pregnant women, elderly adults, and people with disabilities.

Medicare may also be an option for individuals aged 65 and older. Medicare provides emergency health care coverage, often with little to no cost. If you or a family member is 65+ or has specific conditions like End-Stage Renal Disease (ESRD), you may automatically qualify for Medicare. At AHiX Marketplace, we help you understand and access available subsidies, Medicaid, and Medicare to ensure you find affordable health coverage for your family.

9. Maximize Your Family’s Health Insurance Benefits

Once you’ve selected the right emergency health care insurance plan, make sure you maximize its benefits. Take full advantage of preventive care services included in your plan to reduce the risk of needing emergency services. For example, regular screenings and check-ups can help identify health issues before they turn into emergencies.

In case of an emergency, contact your insurance provider immediately to understand your benefits and ensure you are receiving the full coverage you’re entitled to. Having a clear understanding of your policy will save you time and stress when you need emergency care.

10. Consult with Health Insurance Specialists

If you’re unsure which emergency care health insurance plan is right for your family, consulting with an insurance specialist can be a huge help. At AHiX Marketplace, we offer access to licensed specialists who can guide you through the decision-making process. They can help you compare plans, explore subsidies, and ensure that you’re choosing the most cost-effective health insurance emergency coverage for your family.

Conclusion:

Choosing the right emergency health care insurance plan for your family is critical to ensuring you have the protection you need in times of crisis. By understanding your family’s health needs, comparing plan options, and considering factors like premiums, deductibles, and coverage, you can make an informed decision.

At AHiX Marketplace, we provide a range of family health insurance options that offer comprehensive emergency health insurance coverage. Whether you’re interested in ACA-compliant plans, non-qualified plans, or short-term health insurance, we can help you find the best plan for your family’s health and financial situation. Start comparing your options today with AHiX Marketplace and find the peace of mind that comes with knowing you and your family are protected in case of an emergency.

FAQs

1. What is emergency health insurance coverage?

Emergency health insurance coverage is a type of insurance that helps pay for unexpected medical costs in case of an emergency. It covers things like emergency room visits, ambulance services, and hospital stays that arise due to accidents, sudden illnesses, or other emergencies.

2. How can I find affordable emergency health care insurance?

Finding affordable emergency health care insurance involves comparing different plans that fit your needs and budget. At AHiX Marketplace, we offer a wide range of plans, including ACA-compliant, non-qualified, and short-term health insurance options, so you can find the right plan that covers emergency services without breaking the bank.

3. Does emergency health care insurance cover pre-existing conditions?

Emergency health care insurance plans can vary, but ACA-compliant plans are required to cover pre-existing conditions. If you’re looking for coverage for pre-existing conditions, make sure to choose a plan that meets ACA standards. Non-qualified plans might not cover these conditions, so it’s important to review each plan’s details before making a decision.

4. How does health insurance emergency coverage work?

Health insurance emergency coverage helps you pay for emergency medical services. This includes emergency room visits, ambulance transportation, and hospitalization due to unexpected situations. After paying your premium and meeting your deductible, your plan will help cover the costs of these emergency services.

5. Can I get an emergency health insurance plan for just my family?

Yes, you can get family health insurance plans that include emergency health insurance coverage for everyone in your household. AHiX Marketplace offers a variety of family plans designed to meet the specific health needs of each family member, including emergency coverage for all.

6. Is emergency health care insurance expensive?

The cost of emergency health care insurance can vary depending on factors like your coverage needs, the type of plan you choose, and your family’s health situation. ACA-compliant plans tend to have higher premiums but offer comprehensive coverage, while non-qualified plans are usually more affordable but may have limited coverage. At AHiX, we offer plans to suit different budgets, so you can find the best emergency health coverage at a price that works for you.

7. What’s the difference between ACA-compliant and non-qualified health plans for emergencies?

ACA-compliant plans offer complete coverage for emergency health care, including services like hospital stays, ambulance rides, and emergency room visits. These plans follow government regulations and provide extensive benefits, but they often come with higher premiums.

Non-qualified plans, on the other hand, are generally cheaper but might not cover as many services or may have restrictions. If you’re mainly looking for health insurance just for emergencies, a non-qualified plan may be more affordable but could offer less comprehensive coverage.

8. Can short-term health insurance provide emergency health care coverage?

Yes, short-term health insurance can provide emergency health care coverage for a limited time. These plans are a more affordable option, especially if you need temporary coverage while transitioning between jobs or waiting for other insurance to start. However, keep in mind that they might not cover all essential health benefits, so it’s essential to check whether emergency care is adequately covered.

9. How do I choose the right emergency health insurance plan for my family?

When choosing the right emergency plan for your family, consider factors like your family’s health needs, budget, and coverage preferences. If you have young children or elderly family members, a comprehensive plan with extensive coverage might be best. If your family is generally healthy, a more affordable, basic health insurance emergency coverage plan might suffice. At AHiX Marketplace, we offer a range of options, and our specialists can help guide you in choosing the right plan for your family.

10. Can I switch my emergency health insurance plan during the year?

In most cases, you can only change your emergency health insurance plan during the open enrollment period unless you qualify for a special enrollment period (due to events like marriage, job loss, or moving). However, you can review and compare plans anytime to ensure you’re getting the best coverage for your family’s needs. AHiX allows you to explore different plan options throughout the year to make informed decisions.