Retiring Early? Here’s What to Do About Health Insurance Before 65

So, you’re planning to retire early – congratulations!

But here’s the thing you should know: Medicare doesn’t come in until age 65, and you’re left wondering, “How am I supposed to get health insurance in the meantime?”

You’re not alone.

Tens of thousands of Americans retire in their 50s or early 60s every year. Whether it’s by choice, burnout, a buyout, or something unexpected, the one question that always comes up is:

“What are my early retirement health insurance options if I’m not 65 yet?”

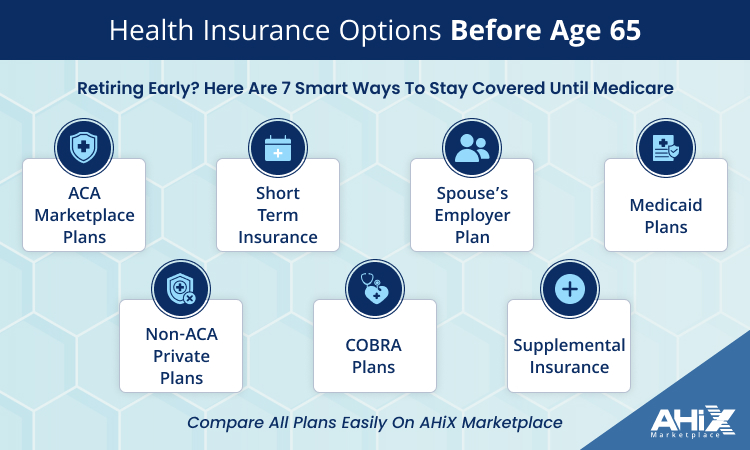

This guide will walk you through:

- All the different coverage options you can consider

- Pros and cons of each (so you know what you’re getting into)

- Real-life examples and important cost info

- How you can compare and enroll fast and securely through AHiX Marketplace

Let’s dive in.

Why Does Health Insurance Get Tricky Before Age 65?

Understanding the Coverage Gap After Retirement

Once you leave your job, your employer-sponsored health insurance usually ends. And unless you qualify for Medicare (which starts at age 65), you’re on your own.

That means if you retire at 55, 60, or even 64, you need a bridge plan, something to cover your healthcare costs until Medicare kicks in.

Without coverage, even a minor medical issue could drain your savings:

- The average 3-day hospital stay in the U.S. costs over $8,500

- A broken leg? Around $5,000

- Monthly prescription costs can add up fast if you have a chronic condition.

And the scary part?

According to Fidelity, the average 65-year-old couple retiring today will need $315,000 just for healthcare expenses throughout retirement.

So finding the right health insurance option before age 65 is not just important, it’s essential.

We’ll walk through all the best early retirement health insurance options for people under 65. Starting with ACA Marketplace Plans (Obamacare).

Option 1: ACA Marketplace Plans (Obamacare) – A Popular Health Insurance Option for Early Retirees

If you’re looking for comprehensive health insurance before 65, ACA Marketplace plans, also known as Obamacare, are often the first place to start.

These plans are regulated under the Affordable Care Act, which means:

- Pre-existing conditions are covered from day one

- You get access to Essential Health Benefits like doctor visits, prescriptions, maternity care, and mental health services.

- And if your income drops after retirement, you might qualify for subsidies that lower your monthly premium.

Why ACA Plans Work Well for Early Retirement

Here’s how ACA health insurance fits into the picture for early retirees:

| Benefit | Why It Matters |

|---|---|

| No medical underwriting | You will not be denied based on age or health status |

| Subsidies available | If retirement income is lower, you can save significantly |

| Covers essential services | Preventive care, prescriptions, ER visits are included |

| Day‑1 coverage | Immediate protection, helpful for chronic conditions |

If you’re 60, retiring early, and have any ongoing health concerns or simply want peace of mind, this is one of the most secure early retirement health insurance options you can get.

What About the Cost?

ACA plan costs vary based on:

- Your age, ZIP code, and annual income

But thanks to the Advanced Premium Tax Credit (APTC), many early retirees find that their monthly premiums are much lower than expected.

But What to Watch Out For

While ACA plans are solid, they’re not perfect:

- Without subsidies, premiums can be high (especially in your 60s)

- Limited networks in some states mean fewer doctors and hospitals to choose from

- You must apply during Open Enrollment (Nov 1 – Dec 15) unless you qualify for a Special Enrollment Period.

But even with those limitations, ACA plans are the go-to choice for many people who retire before 65 and need guaranteed coverage.

Option 2: Non-ACA Private Health Insurance – An Affordable Alternative for Healthy Early Retirees

Let’s say you’re retiring at 60, in good health, and you don’t qualify for ACA subsidies. Suddenly, those full-price ACA plans might look a bit steep. That’s where Non-ACA private health insurance plans come in.

These are off-marketplace health plans that don’t follow the strict rules of the Affordable Care Act, but that also means they’re usually a lot more affordable.

What Are Non-ACA Health Plans?

Non-ACA plans are:

- Private health insurance policies you can buy directly (like through AHiX Marketplace)

- Designed to cover unexpected illnesses or injuries

- Often excludes pre-existing conditions, maternity, or mental health.

These plans can be a smart option for early retirees under 65 who:

- Are generally healthy

- Don’t need full ACA coverage.

- I want to pay less in premiums.

- Just need something until Medicare kicks in.

Pros of Non-ACA Plans for Early Retirement

| Advantage | Why It’s Helpful |

|---|---|

| Lower monthly premiums | Save hundreds vs full‑price ACA plans |

| Flexible plan types | Choose coverage that fits your specific needs |

| Customizable deductibles | Adjust out‑of‑pocket costs to control spending |

| No open enrollment | Enroll anytime, no need to wait for November |

In other words, if you’re 58 or 62 and just want affordable health insurance before Medicare, a non-ACA plan can be a good fit as long as you understand what’s not included.

What These Plans Don’t Cover

- Pre-existing conditions may be excluded or come with waiting periods.

- No coverage for maternity, mental health, or preventive care in most cases

- No access to federal subsidies or cost-sharing reductions

So they’re not for everyone, but if you’re retiring early and in good health, they can be a smart short-term solution.

Who Should Consider a Non-ACA Plan?

This option may be right for you if:

- You’re retiring between 55-64 and don’t need many medical services

- You want to avoid high ACA premiums but still need basic health protection.

- You’re looking for early retirement health insurance with custom coverage options.

Option 3: Short-Term Health Insurance – Flexible, Temporary Coverage Before Medicare

If you’re retiring at 60, 62, or even 64, and just need a few years of coverage until Medicare starts, Short-Term Health Insurance might be the most flexible and cost-effective solution for you.

Short-term plans are designed exactly for situations like this:

You need something now, but just for a little while.

And thanks to recent rule changes, many states now allow up to 36 months of continuous short-term coverage.

Why Early Retirees Choose Short-Term Plans

| Benefit | How It Helps Early Retirees |

|---|---|

| Lower premiums | Save 30–50%+ compared to ACA or COBRA plans |

| Flexible terms | Choose plans from 30 days to 36 months (varies by state) |

| Fast activation | Get covered within 1–2 days after applying |

| Bridge to Medicare | Perfect for retirees within 1–3 years of turning 65 |

Let’s say you retire at 62, you could use a 3-year short-term plan until you’re eligible for Medicare at 65, often at a fraction of the ACA cost.

Important Limitations to Know

Short-term health insurance plans are not ACA-compliant, which means:

- Pre-existing conditions are usually not covered

- No essential health benefits (like maternity, mental health, or preventive care)

- Coverage ends when the term ends (though many plans can be renewed)

Also, coverage rules vary by state. For example:

- Texas, Florida, Arizona: Allow 36-month plans

- California, New York, Massachusetts: Don’t allow short-term plans at all

Want to see if short-term plans are available in your state?

Compare Short-Term Coverage by State

Option 4: COBRA Coverage – Keep Your Employer Plan After You Retire (If You Can Afford It)

If you’re leaving a job that provides good health insurance and want to keep that same coverage after you retire, COBRA might be on your radar.

But here’s the truth:

It’s convenient but not always cheap.

Let’s break it down.

Benefits of COBRA for Early Retirees

| Advantage | What It Means for You |

|---|---|

| Same exact plan | No need to switch doctors or worry about new networks |

| No new application needed | No re-enrollment, underwriting, or plan comparison hassle |

| Covers pre-existing conditions | No interruptions or denials—everything continues as is |

| Lasts up to 36 months | May cover you until Medicare, depending on your situation |

But… It’s Not Cheap

Here’s the catch:

When you opt for COBRA, you pay 100% of the premium plus up to 2% in administrative fees.

That means if your employer was covering part of your premium before, you’re now paying the whole thing. And for someone in their 60s, that can add up to $700–$1,500 per month or more.

So while COBRA is reliable, it’s often the most expensive early retirement health insurance option.

Option 5: Get Covered Through a Spouse’s Employer Plan – A Simple Early Retirement Solution

If your spouse is still working and has access to a solid employer health plan, you might already have the easiest (and most cost-effective) health insurance option lined up.

Joining your spouse’s plan is one of the most seamless early retirement health insurance options available, and in many cases, it’s more affordable than COBRA or private plans.

How It Works

Most employer-sponsored health plans allow employees to add a spouse or dependent during:

- Open enrollment (usually once per year)

- A qualifying life event — like your retirement or loss of coverage

So if you’re retiring at 58, and your partner is still working full-time with health benefits, you may be able to join their plan right away.

Pros of Using Spouse’s Employer Coverage

| Benefit | Why It Works for Early Retirees |

|---|---|

| Good coverage at group rates | Typically, lower premiums than individual market plans |

| Covers you and dependents | May extend to family members in one bundled plan |

| No disruption in care | Stick with familiar doctors and prescriptions |

| No need to shop multiple plans | One plan, one payment, simple management |

This is especially attractive if you’re retiring early and your spouse is years away from retiring.

Watch Out for These Considerations

While this route is convenient, it’s not always perfect:

- Some employers charge a spousal surcharge (extra monthly cost if your spouse has other insurance options)

- Not all plans are robust. Check deductibles, co-pays, and provider networks.

- If your spouse changes jobs or retires, you’ll lose coverage and need a backup plan.

Is It the Best Option for You?

Here’s when joining a spouse’s plan might be the best fit:

- You want minimal disruption in care

- You’re within a few years of Medicare.

- Your spouse is staying employed for the foreseeable future.

- You want to avoid high COBRA premiums or complex plan comparisons.

If this applies to you, it’s often a no-brainer move.

Option 6: Supplemental Health Insurance – Cover the Gaps in Your Early Retirement Plan

Even with a solid health plan in place, you may still face out-of-pocket medical costs that sneak up on you, like dental work, accidents, hospital stays, or critical illness expenses.

That’s where Supplemental Health Insurance can make a big difference, especially if you’re retiring before 65 and trying to stretch your savings without sacrificing care.

Why Supplemental Plans Make Sense for Early Retirees

| Supplement Type | What It Helps Cover |

|---|---|

| Accident Coverage | ER visits, broken bones, ambulance fees |

| Hospital Indemnity | Daily cash benefits for hospital stays |

| Critical Illness | Lump sum for cancer, heart attack, and stroke treatment |

| Dental & Vision Plans | Preventive care, fillings, cleanings, eye exams, glasses |

Here’s the deal: If you’re 60, retired early, and want extra financial protection, a supplemental plan can help avoid dipping into your savings when medical surprises hit.

And yes, you can get first-dollar coverage, which means these plans start paying before you even meet your deductible.

Option 7: Medicaid – Low-Cost or Free Health Insurance If You Retire With Limited Income

If you’re retiring early with a reduced income or limited savings, you may actually qualify for Medicaid, a federal and state-run program offering free or low-cost health insurance.

While Medicaid is often associated with low-income households or families, it’s also one of the most overlooked early retirement health insurance options, especially if your income drops significantly after leaving work.

Why Medicaid Can Be a Lifeline for Early Retirees

| Benefit | How It Helps Early Retirees |

|---|---|

| Free or low-cost coverage | Zero premiums or minimal cost for most enrollees |

| Full essential benefits | Covers doctor visits, ER, prescriptions, and mental health |

| Covers pre-existing conditions | No waiting period, no medical underwriting |

| Available year-round | Apply any time—no open enrollment restrictions |

If you’re retiring at 60 and expect your annual income to fall below your state’s Medicaid threshold, you may qualify automatically, especially if you’re single and no longer earning wages.

Do You Qualify for Medicaid?

Medicaid eligibility is based on:

- Household income

- Family size

- State-specific thresholds

Things to Watch For

- Not all states expanded Medicaid: 10 states (like Texas and Florida) have stricter rules, so eligibility may be harder there.

- Asset limits may apply if you’re seeking long-term care coverage.

- Not ideal if your income fluctuates (e.g., from investments, rental income, etc.)

But if you’re retiring early on a budget, and especially if you’re in a Medicaid expansion state, this option could save you thousands.

AHiX Can Help You Explore All Your Options — Not Just Medicaid

Even if you don’t qualify for Medicaid, AHiX can help you:

- See if you qualify for ACA subsidies instead

- Explore low-cost private or short-term plans.

- Compare all your early retirement health insurance options in one place.

See If You Qualify for Low-Cost Coverage

How Much Does Health Insurance Cost If You Retire Before 65?

Now that we’ve covered all your early retirement health insurance options, one big question remains:

“How much will I need to budget for health insurance before Medicare?”

The answer? It depends on your age, income, location, health status, and the type of plan you choose.

But don’t worry, we’ll break it down clearly so you know what to expect and how to plan ahead.

Example Scenario: 62-Year-Old Early Retiree in Florida

- Annual income after retirement: $35,000

- Eligible for ACA subsidy: Yes

- Premium (after APTC): Around $250/month for mid-tier ACA plan

- Short-term alternative: ~$150/month for a 12-month STM plan

- Supplemental plan add-on: $40/month for accident + hospital coverage

In this case, bundling a short-term + supplemental plan might save over $1,000/year compared to an unsubsidized ACA plan if you’re healthy and don’t need ongoing care.

AHiX Helps You See the Real Numbers Fast

Don’t guess. AHiX Marketplace gives you:

- Instant quotes with your ZIP and basic info

- Side-by-side comparisons across ACA, private, STM, and supplemental plans

- The ability to adjust filters for deductible, network, and out-of-pocket max

See Your Estimated Monthly Premiums

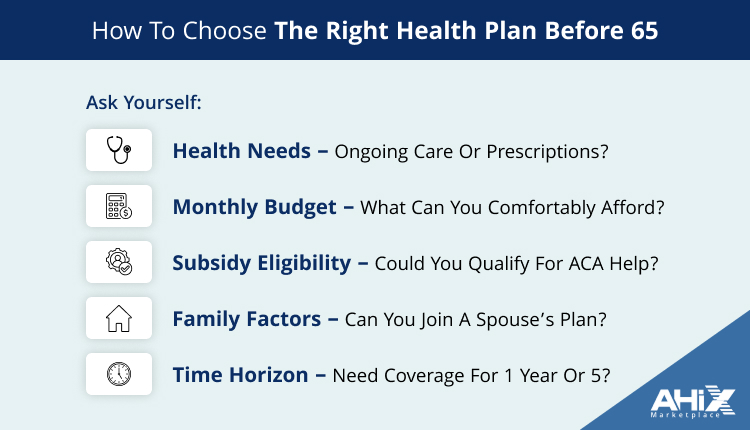

How to Choose the Best Health Insurance Plan for Early Retirement

There’s no one-size-fits-all answer. But with a few simple questions, you can narrow it down fast and make a smart choice that protects both your health and your wallet.

Step 1: Assess Your Health Needs

Ask yourself:

- Do I have any ongoing medical conditions or need regular care?

- Will I need prescription drugs, therapy, or specialist visits?

- Am I planning any procedures or surgeries in the next 1–2 years?

If yes → Consider ACA, COBRA, or your spouse’s plan for robust coverage

If no → You may be fine with a short-term or non-ACA private plan

Step 2: Set Your Monthly Budget

- How much can you realistically spend on premiums?

- Do you want to trade lower premiums for higher deductibles (or vice versa)?

- Would a supplemental plan help you reduce out-of-pocket risk?

Tip: Retiring early often means living on a fixed income, so choosing the right balance between monthly cost and coverage is key.

Step 3: Check Subsidy Eligibility

- Estimate your post-retirement income.

- Use an ACA subsidy calculator (or let AHiX do it for you)

- If eligible, ACA plans can drop from $800/month to under $200/month in some cases.

Step 4: Consider Family or Spouse Factors

- Is your spouse still working?

- Do you need family coverage or just individual?

- Can you join your partner’s employer plan?

This affects both cost and coverage availability.

Step 5: Think About Time Horizon

- Are you retiring at 60 with 5 years to Medicare?

- Or retiring at 63 and only needing a 2-year bridge?

Short-term plans may be ideal for a 12–36 month gap.

ACA or private plans may work better if you need 3+ years of continuous, guaranteed coverage

Still Not Sure? Let AHiX Help You Compare Everything in One Place

No need to stress or spend hours researching.

AHiX Marketplace helps you:

- See only the plans that fit your age, location, and goals

- Instantly compare premiums, networks, and deductibles.

- Bundle in supplemental protection if needed

- Get help from real licensed agents (not just bots)

Take the Guesswork Out of Choosing!

Compare Early Retirement Plans Now

FAQs:

We’ve covered a lot so far. But if you’re still sorting through your early retirement health insurance options, these quick answers might clear things up.

1. What health insurance can I get if I retire at 60?

If you retire at 60, your main options include:

- ACA Marketplace plans (with or without subsidies)

- Short-term medical insurance

- Private non-ACA health insurance

- Spouse’s employer plan

- COBRA (if recently employed)

- Medicaid (if your income qualifies)

The right choice depends on your health needs, income, and how many years you need coverage before Medicare.

2. How do I get health insurance between retirement and Medicare?

This period is often called a “Medicare gap”.

You can bridge the gap using:

- ACA plans (especially with subsidies)

- Short-term or non-ACA plans

- COBRA from your last employer

- Your spouse’s employer plan

- Medicaid, if eligible

Pro Tip: AHiX Marketplace helps you compare all of these in one place.

3. Is there affordable health insurance for early retirees?

Yes, especially if you:

- Qualify for ACA subsidies

- Choose short-term or private plans with lower monthly premiums.

- Add supplemental coverage to reduce high out-of-pocket costs.

Affordable options exist, but they vary by state, age, and income. Always compare based on your zip code.

4. What is the best early retirement health insurance option if I’m healthy?

If you’re retiring early and in good health:

- Consider short-term health insurance (lower cost, flexible terms)

- Explore non-ACA private plans (especially if you don’t qualify for subsidies)

- Add a supplemental plan for peace of mind (accident, hospital, dental)

ACA plans offer full benefits but may be expensive without subsidies.

5. Can I retire at 62 and get health insurance until Medicare at 65?

Yes. You’ll need to choose a plan that covers you for 3 years.

Your best early retirement health insurance options include:

- ACA plans with APTC subsidies

- Short-term plans (if allowed in your state, up to 36 months)

- COBRA (if you just left a job)

- Medicaid (if your income qualifies)

- Your spouse’s employer plan (if available)

AHiX can help you mix and match the right combo.

6. Do I need supplemental insurance before Medicare?

It depends on your main plan.

If you:

- Have a high-deductible plan, or

- Want first-dollar coverage for accidents or hospital stays…

Then yes, supplemental insurance can protect your retirement savings and lower surprise costs.

7. When should I start shopping for early retirement health coverage?

Start as soon as you know your retirement date.

Some plans, like ACA and private insurance, may require:

- Application during Open Enrollment or

- A Special Enrollment Period (after job loss, etc.)

Short-term and supplemental plans are available year-round.

Ready to Find Your Best-Fit Health Plan?

Compare Early Retirement Health Insurance Plans Now

Don’t wait until you’re uninsured or overwhelmed. Take 2 minutes and see what’s available.