As we move into 2026, the search for affordable health insurance remains a key concern for many individuals and families. With the increasing costs of healthcare, it’s essential to understand the wide range of health insurance options available, ensuring you choose a plan that balances both comprehensive coverage and manageable premiums.

Whether you’re exploring individual health insurance, family plans, short-term options, or dental coverage, the landscape of health insurance in 2025 offers diverse choices. However, navigating this variety can be complex, especially with new policies and pricing structures in place.

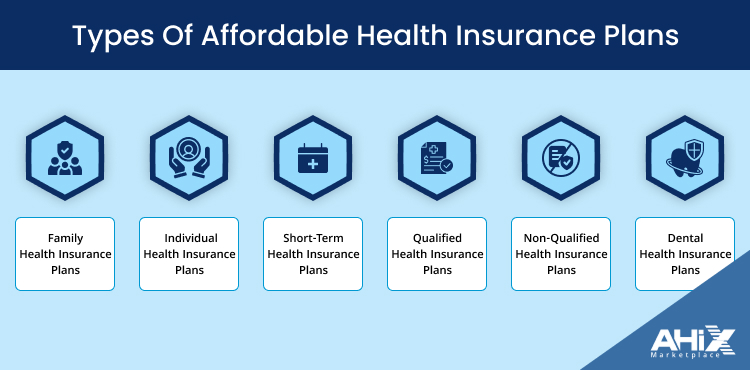

This guide will provide a clear overview of how to find the best affordable health insurance plans for 2025-26, covering the most common types of coverage: individual, family, short-term, qualified, non-qualified, and dental health insurance. By understanding the unique features and benefits of each type, you can make a more informed decision that aligns with both your healthcare needs and financial situation.

In the sections that follow, we will break down these options in detail, helping you navigate the process of selecting affordable health insurance that offers the right coverage at the right price.

Understanding Health Insurance Options in 2025

The landscape of health insurance in 2025 is diverse and complex. With multiple options available, it’s crucial to understand the differences between them to find the best plan for your specific needs. Health insurance plans are designed to protect you from high medical costs, but the affordability and coverage provided by each plan can vary significantly.

The Evolution of Health Insurance

Over the years, health insurance options have evolved in response to changes in healthcare needs, policy regulations, and economic factors. In 2025, consumers have more choices than ever before, thanks to the Affordable Care Act (ACA) and other government policies aimed at expanding coverage. These changes have increased accessibility to health insurance for a broader range of people, but they’ve also made choosing the right plan more challenging.

Challenges with Affordable Coverage

Despite these improvements, finding affordable health insurance remains a challenge for many. Rising healthcare costs, along with complex insurance options, can make it difficult to assess which plans offer the best value. Additionally, many people find themselves balancing between the premium costs and the out-of-pocket expenses, such as deductibles and co-pays. Understanding how these factors impact your overall healthcare spending is key to making an informed decision.

What Makes a Plan Affordable?

When evaluating affordable health insurance, it’s essential to look beyond just the monthly premium. Key factors to consider include the plan’s coverage, deductible, co-insurance rates, and out-of-pocket maximums. A plan with a low premium might seem affordable on the surface, but if the deductibles and co-pays are high, you could end up paying more in the long run.

As you explore different options for 2025-26, it’s important to carefully weigh these factors to ensure you’re selecting the plan that meets both your healthcare needs and your budget.

Types of Affordable Health Insurance Plans

In 2025, there are several types of health insurance plans available, each designed to meet different needs and budgets. Understanding these options is essential for finding affordable coverage that suits your specific healthcare requirements. Below are the most common types of affordable health insurance plans to consider:

1. Family Health Insurance Plans

Family health insurance plans are designed to cover multiple members of a household, including parents, children, and sometimes extended family. These plans often provide a broad range of coverage for healthcare services such as doctor visits, hospital stays, medications, and preventive care.

For families in 2025-26, it’s crucial to compare plans based on premium costs, coverage for each family member, and the network of doctors and hospitals available. While family plans tend to have higher premiums than individual plans, they often offer significant savings per person when compared to purchasing separate policies for each family member.

Key Considerations:

- Family plans usually cover a wide array of health services, including maternity and pediatric care.

- It’s important to look at how many children and dependents are covered and whether the plan includes specific pediatric or maternity benefits.

- Compare the total family premium versus the individual premiums for each member to evaluate overall affordability.

2. Individual Health Insurance Plans

Individual health insurance plans are tailored to individuals seeking coverage for themselves. These plans can be ideal for people who do not need family coverage, such as singles, professionals, or those self-employed.

In 2025-26, individual plans are more customizable, allowing you to select coverage based on your specific healthcare needs. Whether you need coverage for a chronic condition or prefer a plan with a higher deductible to lower your premium, individual health insurance provides flexibility.

Key Considerations:

- When choosing an individual health plan, look at the network of doctors, the availability of specialists, and whether the plan covers medications.

- Assessing your healthcare usage will help determine if a lower premium with a higher deductible is a good option for you.

- Compare plans based on coverage for necessary medical services like prescription drugs, emergency care, and mental health services.

3. Short-Term Health Insurance Plans

Short-term health insurance is designed to provide temporary coverage for people in transition, whether you’re moving between jobs, waiting for other coverage to begin, or needing coverage for a specific short period. These plans tend to offer limited benefits, covering only major medical expenses and offering lower premiums than traditional health plans.

However, they do not cover the same range of services as other health plans, such as preventive care or pre-existing conditions.

Key Considerations:

- Short-term plans are ideal for those who need temporary coverage but are not recommended as a long-term solution.

- Be mindful of the limited coverage offered and the lack of essential health benefits such as maternity or mental health services.

- Compare the cost of a short-term plan to the potential out-of-pocket expenses that might arise due to limited coverage.

4. Qualified Health Insurance Plans

Qualified health insurance plans are those that meet the requirements set forth by the Affordable Care Act (ACA). These plans offer comprehensive coverage, including essential health benefits like maternity care, emergency services, mental health services, and preventive care.

In 2025-26, qualified plans are available through the Health Insurance Marketplace or directly from insurers. These plans are often eligible for subsidies based on your income, making them a great option for those looking for affordable coverage.

Key Considerations:

- Qualified plans are designed to provide full coverage, ensuring you don’t face gaps in coverage for essential services.

- They also provide protection for people with pre-existing conditions, which is critical for those needing ongoing care.

- Eligibility for subsidies or tax credits can make these plans more affordable, depending on your income level.

5. Non-Qualified Health Insurance Plans

Non-qualified health insurance plans are not compliant with the ACA’s minimum coverage requirements. While these plans can be more affordable in terms of premiums, they often do not cover essential health benefits like maternity care or preventive services, and they may exclude coverage for pre-existing conditions.

These plans can be a cost-effective choice for some individuals, but it’s essential to weigh the potential gaps in coverage and limited benefits.

Key Considerations:

- Non-qualified plans may seem attractive due to lower premiums, but they come with significant limitations.

- If you’re healthy and don’t anticipate needing extensive medical care, these plans may be an option to consider. However, if you need comprehensive coverage, they may not be sufficient.

- It’s important to carefully review what is and isn’t covered before selecting a non-qualified plan.

6. Dental Health Insurance Plans

Dental coverage is an essential part of overall health insurance, as it helps pay for routine check-ups, cleanings, fillings, and more complex dental procedures. Some health insurance plans offer dental coverage as an add-on, while others offer standalone dental plans.

In 2025, dental insurance is more affordable than ever, with many plans offering discounts or networks that make it easier to access quality dental care. Whether included in a family or individual health insurance plan or purchased separately, dental coverage should not be overlooked.

Key Considerations:

- Dental insurance can cover a range of services, from basic care like cleanings to more expensive procedures like root canals or orthodontics.

- Look for dental plans with a large network of providers and coverage for both preventive and emergency care.

- Compare the cost of standalone dental insurance versus adding it to a health plan.

How to Find Affordable Health Insurance Plans

Finding affordable health insurance requires careful consideration of your healthcare needs, budget, and available options. In 2025-26, with various types of health insurance plans and pricing structures, it’s important to take the right steps to ensure you’re getting the most value for your money. Here are some practical steps to help you find an affordable plan:

Step 1: Know Your Coverage Needs

Before you start comparing health insurance plans, take a moment to evaluate your healthcare needs. This includes considering any chronic conditions, prescriptions, or regular medical visits you might need. If you have dependents, factor in their needs as well, such as pediatric care or coverage for maternity services. Understanding what you need from a health plan will help you avoid overpaying for unnecessary coverage or under-insuring yourself.

What to Consider:

- Do you need prescription drug coverage?

- Are regular doctor visits or specialist care necessary?

- Do you require mental health services or maternity care?

By evaluating your needs first, you can focus on plans that cover the necessary services and avoid paying for extras you don’t need.

Step 2: Explore Different Health Insurance Marketplaces

Once you’ve assessed your healthcare needs, it’s time to explore the different health insurance marketplaces available. The Health Insurance Marketplace, typically available during open enrollment periods, provides access to a variety of qualified health plans that meet the ACA standards. Depending on your location, you may also have state-specific marketplaces or private insurance providers offering competitive options.

In addition, tools like AHiX Marketplace allow users to compare health insurance plans across multiple providers, helping you find affordable options tailored to your specific needs.

What to Look For:

- Subsidies or tax credits to reduce premium costs.

- Plans that offer the essential health benefits required by the ACA.

- Health plans from trusted insurers that align with your healthcare needs.

Step 3: Evaluate Your Budget

Understanding your budget is crucial when selecting a health insurance plan. While it’s tempting to choose a plan based on the lowest monthly premium, it’s important to consider the total cost of the plan, including deductibles, co-pays, and out-of-pocket maximums. A plan with a low premium but high out-of-pocket costs might not be as affordable in the long run.

Tips for Budgeting:

- Determine how much you can afford to pay each month for premiums.

- Compare the out-of-pocket expenses (deductibles, co-pays) of different plans.

- Consider high-deductible plans if you’re healthy and don’t anticipate frequent medical visits. These plans often have lower premiums but higher deductibles.

Step 4: Check for Available Subsidies or Assistance

If you’re eligible for subsidies, government assistance programs can significantly reduce the cost of health insurance. Many people are unaware that they qualify for subsidies or tax credits under the ACA, which can lower the premiums and make health insurance more affordable. Eligibility is typically based on income, household size, and the state you live in.

Key Actions:

- Review eligibility for premium subsidies through the Health Insurance Marketplace or state-based exchanges.

- See if you qualify for Medicaid, which provides free or low-cost health coverage for low-income individuals and families.

Step 5: Compare Benefits vs. Costs

When choosing an affordable health insurance plan, it’s important to balance the premium cost with the benefits provided. Consider the coverage for essential services such as preventive care, hospital visits, and medications. Sometimes, a plan with a slightly higher premium might offer more comprehensive coverage that ultimately saves you money in the long run.

What to Compare:

- Coverage for necessary services like maternity, mental health, and prescription drugs.

- Networks of doctors and hospitals that are accessible and meet your needs.

- Total out-of-pocket expenses, including co-pays and deductibles, versus the plan’s benefits.

By taking the time to compare different plans thoroughly, you’ll find a balance between affordability and comprehensive coverage that meets your healthcare needs.

Tips for Choosing the Right Affordable Health Insurance Plan

Choosing the right affordable health insurance plan in 2025-26 requires a strategic approach. With so many options available, it’s important to evaluate your personal needs, financial situation, and the specifics of each plan. Here are some tips to guide you in selecting the best plan for both your health and your budget:

1. Look Beyond the Premium

While the premium is an important factor, it’s not the only one. A plan with a low monthly premium may come with high out-of-pocket costs, such as deductibles and co-pays. On the other hand, a plan with a higher premium might offer better coverage and lower out-of-pocket expenses in the long run. When assessing a plan, consider the total cost of care, not just the premium.

What to Consider:

- Review the plan’s deductible, co-pays, and out-of-pocket maximums.

- Compare the overall cost of care over the course of a year, not just monthly premiums.

2. Consider Your Long-Term Health Needs

When choosing a health insurance plan, think beyond your immediate needs. If you anticipate needing ongoing treatment or have a chronic condition, it may make sense to opt for a plan that offers more comprehensive coverage, even if it comes with a higher premium. On the other hand, if you’re generally healthy and don’t need frequent medical care, a higher deductible plan with a lower premium may be sufficient.

What to Consider:

- Do you have any existing medical conditions or long-term health needs?

- Will you require frequent doctor visits or medications?

3. Use Online Tools to Compare Plans

The process of comparing health insurance plans can be time-consuming, but using online comparison tools can simplify it significantly. Platforms like AHiX Marketplace allow users to easily compare plans based on premium costs, coverage options, and out-of-pocket expenses. By using these tools, you can quickly identify the most affordable plans that align with your needs.

What to Consider:

- Use comparison tools to filter plans by premium cost, coverage, and provider networks.

- Ensure the plan covers the essential services you need, such as emergency care, preventive services, and mental health coverage.

4. Check Network Coverage

Different health insurance plans come with different provider networks. If you have a preferred doctor or healthcare facility, make sure they’re included in the network for the plan you’re considering. Out-of-network care can be significantly more expensive, so it’s important to verify that your healthcare providers are covered.

What to Consider:

- Check if your current doctors, specialists, and hospitals are included in the plan’s network.

- Review the costs for out-of-network care if necessary.

5. Don’t Forget about Prescription Coverage

For many individuals, prescription drug coverage is a critical component of their health insurance. When evaluating plans, check if your prescriptions are covered and what the co-pays or deductibles for medications will be. Some plans offer comprehensive drug coverage, while others may only cover a limited list of medications.

What to Consider:

- Verify if your regular prescriptions are included in the plan’s formulary (list of covered drugs).

- Compare co-pays for common medications across different plans.

Conclusion

As we’ve seen, finding affordable health insurance in 2025-26 requires careful consideration of your healthcare needs, financial situation, and the available plan options. With the variety of health insurance plans now offered, including individual, family, short-term, qualified, non-qualified, and dental coverage, there’s a plan suited for nearly every need. However, the key to securing the best deal lies in understanding the details of each plan and choosing one that balances both affordability and coverage.

By evaluating factors such as premiums, deductibles, out-of-pocket expenses, and network coverage, you can identify the most cost-effective plan that meets your requirements. Whether you’re applying for government subsidies, comparing private plans, or considering short-term options, always prioritize the value of the plan in relation to your healthcare needs.

Don’t forget to take advantage of online comparison tools to help you easily compare plans and make an informed decision. Platforms like AHiX Marketplace can assist you in narrowing down your options, ensuring that you get the best possible health insurance plan for your budget and lifestyle.

As you prepare for 2025, remember that affordable health insurance is within reach taking the time to research, compare, and evaluate your options will ensure you secure the coverage you need without breaking the bank.

FAQs

1. What factors should I consider when choosing affordable health insurance?

When choosing an affordable health insurance plan, consider the following factors:

- Premiums: The monthly cost you’ll pay for coverage.

- Deductibles and Co-pays: Understand how much you’ll need to pay out-of-pocket for medical services.

- Network Coverage: Ensure your preferred doctors and hospitals are included in the network.

- Prescription Coverage: If you take medications regularly, check if they’re covered by the plan.

- Essential Services: Ensure the plan covers necessary services such as preventive care, emergency services, and specialty care.

2. Can I get affordable health insurance if I’m self-employed?

Yes, self-employed individuals can access affordable health insurance through the Health Insurance Marketplace or private insurers. Depending on your income, you may also qualify for subsidies that can reduce your premiums. Be sure to compare plans carefully to find one that fits your healthcare needs and budget.

3. How do subsidies work with health insurance plans?

Health insurance subsidies, available through the Health Insurance Marketplace, help lower the monthly premiums for those with lower incomes. Subsidies are typically based on household size and income level. If you qualify, you may also be eligible for cost-sharing reductions, which help reduce out-of-pocket expenses like deductibles and co-pays.

4. What is the difference between short-term and long-term health insurance plans?

Short-term health insurance plans provide temporary coverage and are ideal if you need insurance for a brief period. They often come with lower premiums but limited coverage. Long-term health insurance, such as ACA-compliant plans, provides more comprehensive coverage and is ideal for individuals seeking continuous coverage with essential health benefits.

5. Are dental plans included in health insurance?

Dental coverage can be included in some health insurance plans, but many plans offer dental as a separate, add-on policy. It’s important to check the specifics of the health insurance plan you’re considering to determine if dental coverage is included. If it’s not, standalone dental plans are available for purchase to help cover routine and major dental care.

6. How can I find the best affordable health insurance plan for my family?

To find the best affordable family health insurance plan, start by evaluating your family’s healthcare needs. Compare premiums, coverage options, and the plan’s network of healthcare providers. Be sure to factor in coverage for pediatric care, maternity, and preventive services. Using tools like AHiX Marketplace can help you compare different family plans based on your needs and budget.

7. Can I change my health insurance plan outside of open enrollment?

In most cases, you can only change your health insurance plan during open enrollment. However, if you experience a qualifying life event—such as marriage, having a baby, or losing other coverage you may be eligible for a Special Enrollment Period (SEP), allowing you to change your plan outside of the typical open enrollment window.

8. What is the best way to compare health insurance plans?

The best way to compare health insurance plans is to use online comparison tools, which allow you to filter plans based on factors such as premiums, coverage options, deductibles, and provider networks. Look for a plan that meets your healthcare needs and fits your budget.

9. How does my income affect the cost of health insurance?

Your income directly impacts the cost of health insurance, especially if you’re applying for subsidies. The lower your income, the more likely you are to qualify for subsidies that can reduce your monthly premium. Some plans also offer cost-sharing reductions, which can help lower your out-of-pocket expenses for things like deductibles and co-pays.

10. Is health insurance cheaper if I don’t need much medical care?

Health insurance premiums are generally lower for healthy individuals who don’t require frequent medical care. However, it’s essential to balance the premium with the plan’s coverage and out-of-pocket costs. High-deductible plans with lower premiums may be a good option if you’re generally healthy, but keep in mind that these plans may require higher costs when you need care.