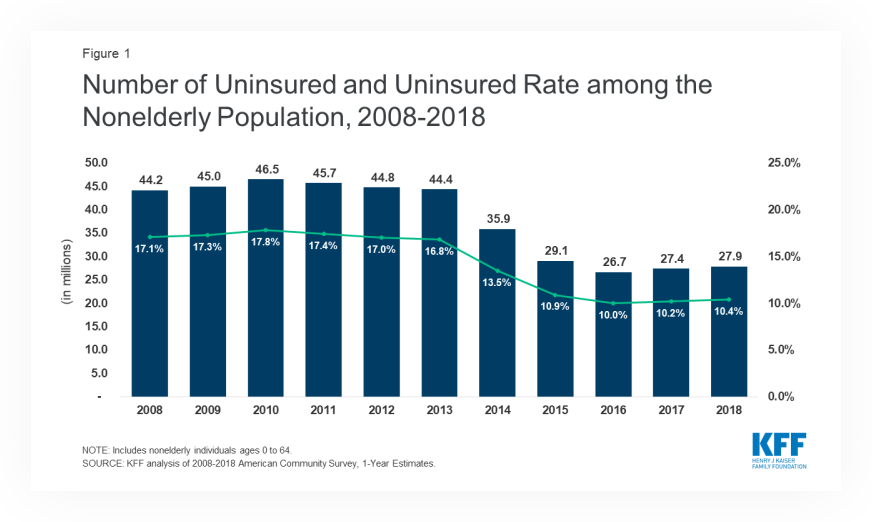

Did you know that out of the 27.5 million uninsured Americans, most say they’re uninsured because there are not enough affordable options? Although many are eligible for financial assistance, navigating through finding the right plan is time-consuming, overwhelming, and expensive.

These factors play into why so many Americans decide to go uninsured despite the fact that having affordable health insurance is beneficial. With coverage, you’ll have lower out-of-pocket costs, which means you’re less likely to go bankrupt from medical expenses. People with insurance are also more prone to go to the doctor to receive preventive care, which helps increase longevity.

And yet, finding an affordable health plan seems next to impossible. If you are one of the millions of Americans looking for inexpensive health insurance, then there are a few things to know as you begin your search.

How to Find Affordable Health Insurance Plans

When the Affordable Care Act (ACA) was introduced in 2010, the intent was to help millions of uninsured Americans gain affordable health insurance plans with guaranteed coverage at fair prices. The act, also nicknamed Obamacare, helped insure nearly 20 million Americans within a few years, but many still opted out because they preferred low cost health insurance options.

Figure 1: Number of Uninsured and Uninsured Rate among the Elderly Population, 2008-2018

If you can’t afford Obamacare or don’t qualify for subsidies, there is still good news for you. There are plenty of affordable health insurance plan options — you just have to know what to look for. First, it’s best to become familiar with the types of plans, programs, and coverages that you might qualify for.

Step #1

Which Insurance Program Do You Qualify For?

Before choosing the right health insurance, you have to consider your lifestyle, your income, and your cost of living. Measuring these things will help you determine where you stand on the federal poverty level. For example, if you can’t go through your employer, then social insurance might be a more affordable option. For those who are low-income and require more consistent medical care, welfare insurance is better.

Private Insurance

Private insurance refers to insurance plans that are offered explicitly by private insurance companies, making them independent of government-sponsored programs. Currently, more than half of the population uses private insurance through their employer or purchases it directly from the insurer.

Social Insurance

Social insurance is a government-sponsored program that is funded by the taxes or premiums paid by participants. Some popular programs are Social Security, Medicare, and state-sponsored unemployment insurance. It intends to serve as public insurance that provides people protection against economic risks that typically come with unexpected medical costs.

Individual Welfare

Welfare insurance is typically referred to as Medicaid, which is a government-sponsored system that helps cover citizens based on their medical and insurance needs. Medicaid usually covers low-income adults, children, pregnant women, elderly adults, and people with disabilities. Services are designed to offer specific benefits, like nursing home care.

Step #2

Do You Need an Individual or Family Policy?

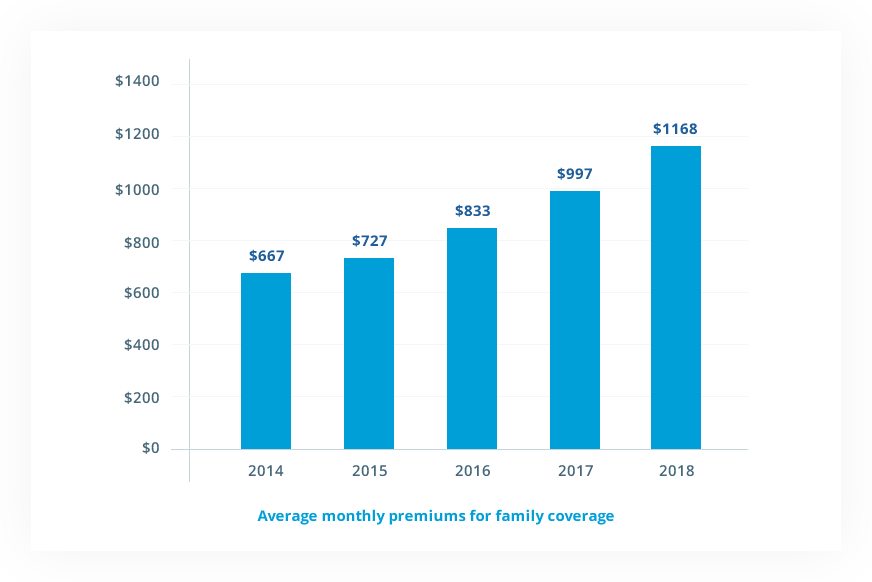

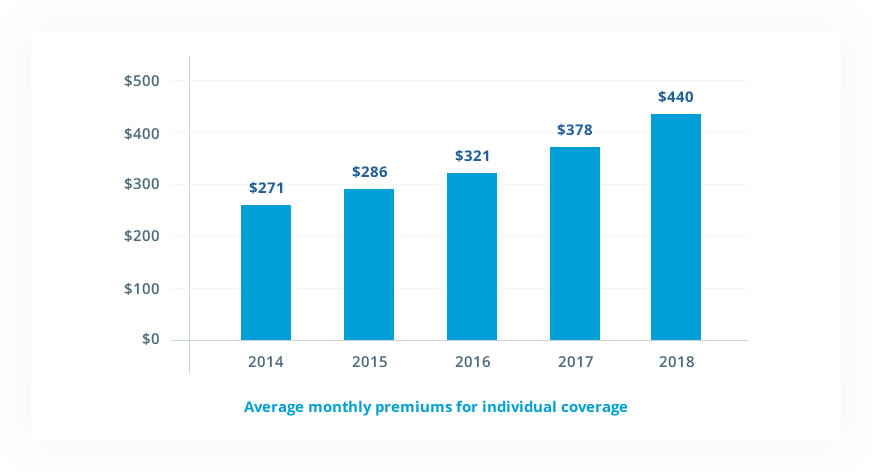

The main difference between individual and family coverage is how you receive the insurance and who it is for. The cost for each will vary, and recent years have seen the cost for everyone go up:

This trend only magnifies the need to find affordable health insurance plan, and knowing what to shop for will help you make the best decision for your needs. Let’s briefly look at the difference between individual and family policies.

Individual Health Insurance Policy

Individual health insurance is a health policy that you select for yourself and is not employer-sponsored. Most unmarried, divorced, or single adults who are not eligible for coverage from their employer will choose individual health insurance as their plan of choice.

Here are the costs to consider when purchasing an individual policy:

- Premiums:Premiums are the monthly payments you make towards your insurance. The average cost for an individual insurance policy is $440 per month.

- Deductibles:The deductible is the amount you pay out-of-pocket before your health insurance takes over the rest of the payment. You will have an annual limit for you and your family where you must pay for any additional care out-of-pocket. The average individual deductible is $4,578.

Family Health Insurance Policy

Family health insurance is a health policy that you purchase yourself, is not employer-sponsored and intends to cover you, your spouse, and eligible dependents. Family health plans are essentially individual policies with dependents added to the coverage.

As with any policy, there are a couple of costs to keep in mind:

- Premiums:The average cost for family coverage is $1,168.

- Deductibles:The average family deductible is $8,232.

Step #3

Is a Qualified Plan or Non-Qualified Plan Better for You?

There are two types of plans you could choose from: qualified plans and non-qualified plans. All qualified plans meet the ACA regulations. Typically these will have higher costs because of the amount of coverage and benefits you receive. On the other hand, non-qualified plans might include alternatives like short-term health insurance or indemnity health insurance.

OPTION#1

Qualified Plans

A qualified health plan is approved by the HealthCare.gov Marketplace, and provides care that helps cover at least 60% of your out-of-pocket costs without being denied coverage based on your age, geographical location, or tobacco usage.

Qualified plans are best for those who:

- Require prescribed medication

- Qualify for a low-income government subsidy

- Receive regular care for a specific condition

- Have a spouse or dependents to covers

All ACA-compliant plans must cover the ten essential health benefits, like preventive services, emergency services, pediatric care, and more.

OPTION#2

Non-Qualified Plans

Non-Qualified plans are health insurance plans that are not ACA-compliant, meaning they do not follow the ACA guideleines and do not cover all ten essential health benefits. Although there is less coverage, non-qualified health plans might be for you if you can’t afford Obamacare and are looking at alternative affordable health insurance options. Some popular choices are short-term health insurance and indemnity insurance plans, which are generally cheaper and only cover necessary things.

Non-qualified plans are best for those who:

- Don’t need medical prescriptions

- Are generally healthy

- Don’t visit the doctor regularly

- Do not suffer from mental illness or substance abuse

- Are not pregnant or planning to become pregnant

If you only want a plan that helps you in the event of an unexpected illness or injury, then non-qualified options might be a better fit for you and your family.

Conclusion

If you don’t qualify for employer-sponsored coverage, then your options might seem a little out of reach, and buying your health insurance from popular providers can get expensive and cause substantial financial debt. So if you are looking for a cheaper option that only covers the necessities like primary and emergency care, then it might be best to consider affordable options that work better for you.

Navigating the world of health insurance can be overwhelming, but with careful consideration and research, finding affordable health insurance plan is possible. By exploring different plans, considering high-deductible options, exploring government programs, utilizing health insurance marketplaces, considering HSAs, staying in-network, and reviewing your coverage regularly, you can find a plan that fits your needs and budget.

Remember, health insurance is an important investment in your well-being, providing peace of mind and financial protection against unexpected medical expenses. Take the time to explore your options and find a plan that works for you.

1. How do I get cheap health insurance?

To get cheap health insurance, compare quotes, consider high-deductible plans, explore government programs, use health insurance marketplaces, and consider health savings accounts (HSAs).

2. What is the best health insurance?

The best health insurance varies based on needs and circumstances. Consider coverage options, network, costs, and customer service when choosing a plan.

3. Can you negotiate the cost of health insurance?

While you can’t negotiate premiums directly, you can find more affordable coverage by exploring different plans, options, and employer benefits.

4. Do I need health insurance?

Yes, having health insurance is crucial for financial protection against medical expenses. Under the ACA, most individuals are required to have coverage, and accidents or illnesses can happen unexpectedly.

If you’re not sure where to start, then begin by finding an insurer that offers both qualified and nonqualified plans. There, you can get quotes and customize your ideal plans on a budget you can afford.