If you’ve ever looked for health coverage outside of government marketplaces, you’ve probably come across the term Non ACA health insurance. These are insurance plans that don’t follow the rules set by the Affordable Care Act, and they’re designed for people who need flexible, short-term, or lower-cost alternatives to standard health coverage.

Whether you’re self-employed, between jobs, or simply in good health and seeking a basic safety net, Non ACA plans offer a different path. They provide access to essential medical services at a lower cost, but with some trade-offs in terms of coverage and protection.

In this guide, we’ll explain exactly what Non ACA insurance plans are, how they work, who they’re best suited for, and the key advantages and disadvantages you need to consider. By the end, you’ll have a clear understanding of whether a private, off-exchange health plan could be a smart choice for your situation or if you’re better off sticking with an ACA compliant option.

What Is a Non ACA Health Insurance Plan?

Non ACA Health Insurance refers to health plans that do not meet the coverage standards set by the Affordable Care Act. These plans operate outside the federal marketplace and are considered private health insurance options. While they don’t include ACA-required benefits, they’re often used as practical solutions for people who need more affordable or temporary coverage.

Unlike ACA-compliant plans, Non ACA policies are not required to cover essential health benefits such as maternity care, mental health services, or preventive screenings. Instead, they focus on core medical needs like emergency care, doctor visits, and hospitalization. This limited scope allows insurers to offer lower monthly premiums, but it also means less protection for consumers.

Common types of Non ACA insurance include:

- Short-term health insurance plans

- Fixed indemnity plans

- Healthcare sharing ministries

- Limited benefit medical plans

These plans often use medical underwriting, which means applicants may be denied based on their health history. While that may seem like a drawback, it also allows providers to keep costs lower for healthy individuals. In short, Non ACA insurance plans are not a replacement for traditional comprehensive coverage, but they can serve specific needs for certain individuals, especially when budget or timing is a concern.

How Does Non ACA Health Insurance Work?

Non ACA Health Insurance works differently from plans found on government marketplaces. These policies are offered through private insurers and typically have a simplified application process, often allowing applicants to enroll year-round without waiting for open enrollment periods.

To qualify, most Non ACA plans require medical underwriting. This means you may be asked health-related questions, and pre-existing conditions could lead to higher rates or denial of coverage. Unlike ACA plans, these policies aren’t required to accept all applicants regardless of health status.

Once approved, coverage can begin within 24 to 48 hours, making them a popular choice for those needing immediate or short-term health insurance. Plan duration varies, but many policies are available for terms of 30 to 364 days, and some can be renewed depending on the provider and state regulations.

What’s typically covered includes:

- Emergency room visits

- Hospital stays

- Doctor consultations

- Limited prescription benefits

However, most Non ACA insurance plans do not cover preventive care, maternity, mental health services, or chronic disease management. These exclusions are what keep premiums lower, but they also highlight the importance of knowing your medical needs before enrolling. Understanding how these plans operate is key to deciding whether they’re a good fit for your short-term or low-cost coverage goals

Pros of Non ACA Health Insurance

For individuals seeking affordable and flexible medical coverage outside of standard ACA offerings, Non ACA Qualified Health Insurance Plans provide several important advantages. These plans are often selected for their ability to fill short-term coverage gaps or reduce overall monthly healthcare costs.

Here are some key benefits to consider:

- More Affordable Premiums

One of the most notable benefits of these private plans is their lower cost. Since they are not required to meet every ACA coverage mandate, premiums are often significantly less, especially for healthy applicants. - Year-Round Enrollment Options

Unlike marketplace insurance, Non ACA compliant health insurance can be purchased at any time of year. This makes them particularly useful during transitions, such as job changes or early retirement. - Faster Activation

Most plans offer expedited approval processes, with coverage starting as soon as the next day. This makes them a reliable choice for individuals needing immediate protection. - Custom Coverage Durations

Plan terms are flexible, often ranging from 30 days to 12 months. This allows individuals to align their policy duration with their specific needs. - Best Suited for Short-Term Needs

The best Non ACA health insurance options are often ideal for those who don’t qualify for ACA subsidies but still want some level of protection.

Used strategically, these plans can be an effective bridge between major coverage periods without the high cost of full marketplace plans.

Cons of Non ACA Health Insurance

While Non ACA Qualified Health Insurance Plans offer affordability and flexibility, they also come with limitations that are important to consider before enrolling. These drawbacks often explain why such plans are not suitable for everyone, especially those with ongoing or complex medical needs.

Here are the most common concerns:

- Limited Coverage for Pre-Existing Conditions

Unlike ACA-compliant plans, most Non ACA compliant health insurance does not cover pre-existing conditions. Applicants may be denied based on medical history, or existing conditions may be excluded from coverage. - No ACA Subsidies

Individuals purchasing health insurance Non ACA are not eligible for federal subsidies. This means the full premium cost must be paid out-of-pocket, which may not be affordable for everyone. - Exclusions and Caps

These plans often have benefit limits, including caps on total coverage amounts. Common exclusions include maternity care, mental health services, preventive screenings, and prescription drugs. - Short-Term Solution Only

These policies are typically not intended as long-term health coverage. They are best used to fill temporary gaps in coverage and may not be renewable, depending on the provider, plan type, and regulations. - Higher Financial Risk

With fewer mandated benefits and higher deductibles, policyholders may face substantial out-of-pocket costs in the event of serious illness or injury.

For those considering alternatives to ACA plans, it’s important to weigh these risks against the advantages and carefully assess personal health needs before choosing a policy.

Who Should Consider a Non-ACA Plan?

Not every health plan fits every individual. Private health insurance options outside of the ACA marketplace are often designed for people in very specific life situations usually when traditional coverage isn’t necessary, available, or affordable.

You may want to consider one of these Non ACA health insurance plans if you fall into one of the following categories:

- You’re between jobs and need temporary coverage

Short-term plans can serve as a low-cost bridge until your next employer-sponsored insurance begins. - You’re self-employed or freelance without ACA subsidies

If you earn too much to qualify for premium tax credits, off-market options may be more affordable. - You’re in good health with no ongoing medical conditions

For individuals with minimal healthcare needs, the savings on premiums can outweigh the risk of limited coverage. - You’re retiring early but not yet eligible for Medicare

These plans can provide a stopgap solution without the cost of full marketplace coverage. - You’re a recent college graduate aging out of a parent’s plan

Affordable, flexible, and quickly activated, health insurance not on the marketplace may meet your temporary needs until a more permanent solution is available.

Choosing a non-marketplace plan should be based on your health history, budget, and the amount of risk you’re willing to manage.

Key Differences: ACA vs. Non ACA Plans

Understanding the distinction between marketplace plans and Non ACA compliant health insurance is essential for making an informed decision. While both provide access to medical coverage, they are fundamentally different in how they operate, what they cover, and who they serve.

The table below outlines the most important differences:

| Feature | ACA Plans | Non-ACA Plans |

|---|---|---|

| Coverage Requirements | Must cover 10 essential health benefits | Coverage is limited and varies by plan |

| Pre-Existing Condition Coverage | Guaranteed | Often excluded or denied |

| Subsidies Available | Yes, based on income | Not available |

| Enrollment Period | Restricted to annual Open Enrollment or Special Enrollment Periods | Available year-round |

| Medical Underwriting | Not allowed | Usually required |

| Out-of-Pocket Caps | Regulated and capped | Varies or may be unlimited |

| Plan Duration | Year-long or permanent | Varies, but often limited to several months |

While ACA Qualified Health Plans offer broad protection and financial assistance, off-exchange health plans provide more flexibility and affordability for those who qualify. Knowing these coverage differences can help you match the right plan to your health and financial situation.

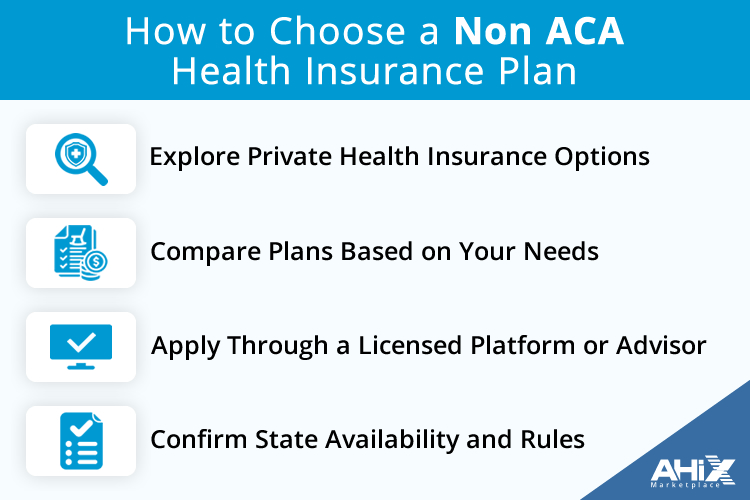

Choosing the Right Non-ACA Health Insurance Plan:

If you’re considering an alternative to marketplace coverage, it’s important to understand how to choose a Non ACA insurance safely and effectively. These plans are not sold through federal or state exchanges, so the purchasing process is different.

Here’s how to choose to get started:

- Explore Private Health Insurance Options

Look for licensed insurance providers or brokers that offer Non ACA qualified health insurance plans directly to consumers. Avoid third-party sites that lack transparency. - Compare Plans Based on Your Needs

Review what’s covered, what’s excluded, deductible amounts, and term lengths. Some plans may appear inexpensive but offer very limited protection. - Apply Through a Licensed Platform or Advisor

A certified broker or a trusted site like AHiX can guide you through the selection process, ensure compliance with state rules, and help you avoid misleading policies. - Confirm State Availability and Rules

Plan options and rules vary by state, including renewal limits and coverage terms. Always read the policy details carefully before enrolling.

This approach helps you choose a plan that fits both your medical needs and financial goals.

Final Thoughts: Is Non ACA Health Insurance Right for You?

Choosing the right health coverage depends on your individual needs, financial situation, and how long you need the policy. For those seeking flexibility, the best non marketplace health insurance plans can serve as an effective solution, especially when traditional coverage isn’t available or affordable.

If you’re healthy, in a transition period, or ineligible for subsidies, these plans offer temporary health coverage at a lower monthly cost. However, they come with trade-offs, less comprehensive benefits, and limited protections for pre-existing conditions. These policies work best as short-term options, not long-term solutions. If you anticipate needing regular care, prescription coverage, or preventive services, it’s wise to compare all available choices first.

Before making a decision, consider your health history, risk tolerance, and how much protection you need. Reviewing policy details closely and working with a licensed advisor can help you confidently select the right coverage without overpaying or under-insuring.

FAQs:

1. What is considered a Non ACA Health Insurance plan?

A Non ACA Health Insurance plan is any policy that does not comply with the Affordable Care Act. These plans are not required to include all ten essential health benefits and often use medical underwriting to determine eligibility and pricing.

2. How long can someone stay covered under a Non ACA plan?

Coverage duration varies but is usually limited to short-term periods ranging from one month to just under a year. Some plans may be renewable, but long-term use is generally not recommended due to limited benefits.

3. How fast does coverage begin with Non ACA health plans?

Many Non ACA policies can start within 24 to 48 hours after your application is approved. This makes them ideal for individuals needing immediate short-term health coverage.

4. Do Non ACA insurance plans offer access to nationwide providers?

Some plans may include broad networks, but access varies by provider. It’s essential to review each plan’s network details to determine whether you can use providers across multiple regions.

5. What medical services are typically excluded from Non ACA plans?

Non ACA plans often exclude services like maternity care, preventive screenings, mental health treatment, substance abuse support, and pre-existing condition management.

6. Why do Non ACA plans require medical underwriting?

Because these plans are not guaranteed, insurers assess your health history to decide whether to offer coverage. This allows them to price plans more affordably for healthy individuals.

7. Can a family use a single Non ACA plan for everyone?

Yes, some Non ACA plans offer family coverage, but each member’s eligibility and exclusions may differ. Always review the policy to understand how benefits apply to dependents.

8. Do Non ACA plans meet government health insurance requirements?

No, Non ACA plans do not meet ACA minimum essential coverage standards and may not fulfill health insurance mandates required by some states.

9. How does a Non ACA plan differ from a marketplace plan?

Marketplace plans follow ACA rules and include full essential health benefits, income-based subsidies, and guaranteed acceptance. Non ACA plans are sold privately and typically offer fewer benefits at a lower cost.

10. Can a Non ACA plan be canceled at any time?

Yes, most Non ACA plans allow cancellation without penalties. Cancellation policies may vary by provider..

11. Is urgent care typically covered in Non ACA insurance plans?

Some Non ACA plans offer limited urgent care coverage, but it’s not guaranteed. Always check the plan documents to confirm what emergency or urgent services are included.

12. Are income levels considered when applying for Non ACA plans?

No, income does not affect eligibility or pricing for Non ACA Health Insurance. These plans do not offer subsidies and are not tied to income thresholds.

13. What happens if a new condition develops during a Non ACA plan term?

Most Non ACA policies will cover new health issues that occur during the plan term. However, coverage may not extend if the condition continues beyond the original plan period.

14. Can Non ACA plans be renewed after expiration?

Some may be renewed, but many are non-renewable or limited by state regulations. In some cases, you may need to reapply and pass medical underwriting again.

15. How can I verify that a Non ACA plan is legitimate?

To ensure safety, purchase plans through licensed brokers or verified insurance providers. Look for transparent terms, clear exclusions, and proper licensing to avoid misleading coverage.