Every year, millions of people face the important decision of reviewing their health insurance during open enrollment. This period is your opportunity to make changes, switch plans, or sign up for new coverage that fits your needs. Missing it can mean being locked into a plan that may not give you the right protection or value.

Understanding the benefits of open enrollment is essential. It is not just about choosing any plan but about making informed choices that can improve both your health coverage and financial security for the year ahead. By learning how open enrollment works and what advantages it offers, you can make smarter decisions that match your healthcare needs and budget.

In this guide, we will walk through what open enrollment means, the benefits it brings, and how to confidently choose the right health insurance plan.

What Is Open Enrollment?

Open enrollment is a set period each year when you are allowed to sign up for a new health insurance plan or make changes to your existing one. Outside of this period, your options are usually limited unless you qualify for a special enrollment event such as marriage, birth of a child, or loss of other coverage.

During this window, you can explore different health plans, compare coverage options, and decide whether your current plan still meets your needs. The benefits open enrollment provides include the chance to adjust your plan if your circumstances have changed, whether that means new medical needs, a growing family, or simply wanting a plan with better cost control.

This period is important because once it closes, you are committed to the plan you selected for the entire year. Taking the time to understand how open enrollment works can help you avoid costly mistakes and ensure that you have the right coverage in place when you need it most.

Key Benefits Open Enrollment Offers

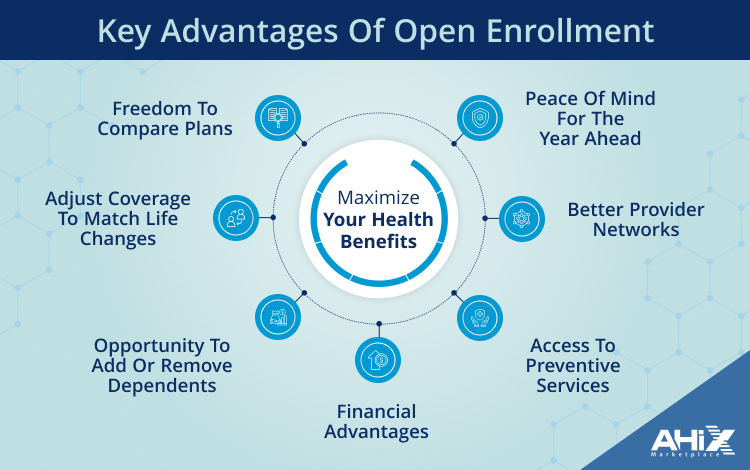

One of the main reasons open enrollment matters is the wide range of advantages it gives you as a policyholder. This period is designed to make sure people have a fair chance to update or select the coverage that works best for them. Below are some of the most important benefits open enrollment provides.

1. Freedom to Compare Plans

During open enrollment, you are not locked into your current health insurance. You can look at other plans side by side, compare costs, review networks, and decide whether another option better matches your needs. Having this choice can make a big difference in both coverage and savings.

2. Adjust Coverage to Match Life Changes

Life does not stay the same, and neither should your health plan. If you got married, had a baby, or developed new health concerns, open enrollment allows you to update your plan accordingly. This flexibility helps ensure you are not paying for coverage you no longer need or missing protection that has become important.

3. Opportunity to Add or Remove Dependents

If you need to add a spouse, child, or dependent parent to your plan, this is the time to do it. Likewise, if someone no longer needs coverage under your plan, you can remove them. This keeps your policy accurate and cost-effective.

4. Financial Advantages

Another important benefit is the chance to select a plan that helps you manage your healthcare costs. You can compare deductibles, copayments, and out-of-pocket limits to find the balance between monthly premiums and yearly expenses that works best for your budget. Making a smart choice during open enrollment can save you significant money over the year.

5. Access to Preventive Services

Many health plans cover preventive care such as annual checkups, screenings, and vaccinations at no additional cost. By reviewing your plan options during open enrollment, you can ensure you select coverage that prioritizes preventive services and long-term wellness.

6. Better Provider Networks

The quality of your care often depends on which doctors and hospitals are in your plan’s network. Open enrollment gives you the chance to switch to a plan with a network that includes the providers you prefer or need for specialized care.

7. Peace of Mind for the Year Ahead

Perhaps the most valuable benefit is peace of mind. Knowing you have the right coverage in place gives you confidence that if a medical issue arises, you are financially protected. This sense of security is one of the biggest reasons to take open enrollment seriously.

How to Evaluate Health Insurance Plans

Open enrollment offers choices, but the real challenge is deciding which plan is best for you. Understanding how to evaluate your options is the key to making the most of the benefits open enrollment provides. Here are the main factors to consider when comparing plans.

1. Premiums vs Out-of-Pocket Costs

The monthly premium is what you pay to keep your plan active. But that is only part of the cost. Deductibles, copayments, and coinsurance add up when you use healthcare services. A plan with a low premium might look appealing, but could leave you paying more overall if you need frequent care. On the other hand, a higher premium might give you lower out-of-pocket costs. Balance both sides to match your healthcare usage and budget.

2. Provider Networks

Every plan has a network of doctors, hospitals, and specialists. Staying within the network usually means lower costs. If you already have trusted doctors, check whether they are covered. If you need access to certain specialists or medical centers, confirm they are in the plan’s network before enrolling.

3. Prescription Drug Coverage

Medication can be one of the biggest expenses in healthcare. Each plan has a formulary that lists covered drugs and their cost tiers. Look at whether your prescriptions are included and what you will pay for generics and brand-name drugs. This step can prevent unexpected costs throughout the year.

4. Types of Coverage Offered

Some plans include extra benefits such as dental, vision, mental health services, or wellness programs. Review which benefits matter most for you and your family. Choosing a plan that covers more of your needs may save you from buying separate add-on policies later.

5. Flexibility of Care

Health insurance plans differ in how much freedom they give you to see providers. For example, HMO plans often require referrals and limit you to specific providers, while PPO plans usually allow more flexibility. Understanding the structure of your plan helps you know what kind of access you will have to care for.

6. Quality Ratings and Reviews

Many marketplaces and employers provide plan ratings based on customer feedback, quality of care, and service. Checking these ratings can give you insight into how the plan performs in real-world situations.

Evaluating these factors carefully will help you select a plan that balances cost, coverage, and convenience. By using open enrollment to compare all these details, you ensure that your choice will support both your health and your finances for the year ahead.

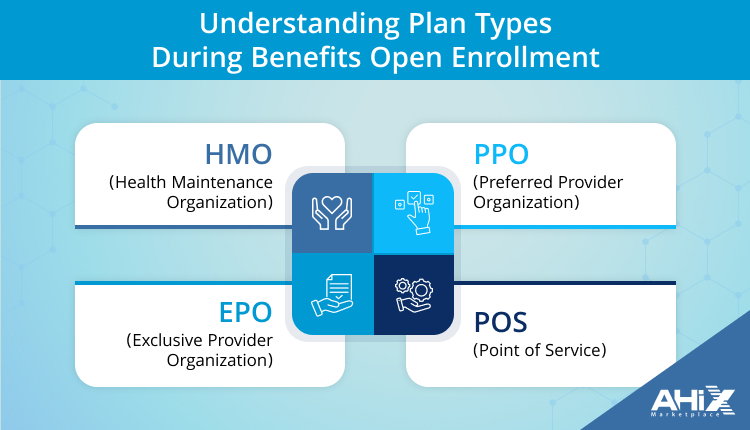

Understanding Plan Types and Terms During Benefits Open Enrollment

Health insurance can feel confusing because of the many plan types and industry terms involved. Open enrollment is the perfect time to get clear on what these words mean, since they directly affect the kind of coverage you receive and the costs you pay. Knowing these basics will help you make the most of the benefits open enrollment provides.

Common Plan Types

- HMO (Health Maintenance Organization): Usually has lower costs but requires you to stay within a set network of doctors. Referrals are often needed to see specialists.

- PPO (Preferred Provider Organization): Offers more flexibility in choosing doctors and hospitals, often without referrals, but premiums and costs may be higher.

- EPO (Exclusive Provider Organization): A middle option that combines features of HMOs and PPOs. Care outside the network is usually not covered except in emergencies.

- POS (Point of Service): Requires referrals for specialists but gives limited out-of-network options at higher costs.

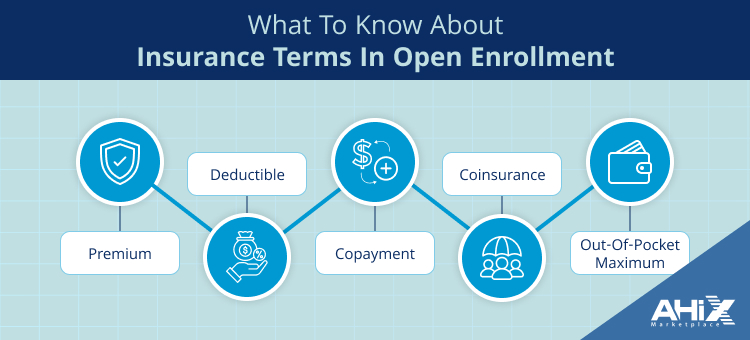

What to Know About Plan Terms Before Enrolling:

- Premium: The amount you pay every month to keep your insurance active.

- Deductible: The amount you pay out of pocket before your insurance starts covering costs.

- Copayment: A fixed fee for certain services like doctor visits or prescriptions.

- Coinsurance: The percentage of medical costs you share with your insurer after meeting your deductible.

- Out-of-Pocket Maximum: The maximum you will pay in one year for covered services. Once you hit this limit, the plan covers 100% of eligible costs.

By understanding these terms and plan types, you can better compare your options during open enrollment. This knowledge makes it easier to avoid surprises later and ensures you choose a plan that aligns with your needs.

Timeline and Deadlines for Benefits Open Enrollment

Knowing when open enrollment starts and ends is just as important as understanding the plans themselves. If you miss the window, you may be locked out of making changes for the year unless you qualify for a special enrollment event such as marriage, childbirth, or losing other coverage.

For most people, the open enrollment period for health insurance runs from November 1 to January 15. This is the time to review your current plan, compare options, and make changes if needed. Some employers or state-based marketplaces may set slightly different deadlines, so it is always wise to double-check your exact dates.

The benefits open enrollment provides are only available if you act before the deadline. Waiting until the last minute can lead to rushed decisions or missing the cut-off altogether. Mark the dates on your calendar, set reminders, and give yourself enough time to explore every option before making a final choice.

By paying attention to the timeline, you protect yourself from penalties, gaps in coverage, or being stuck in a plan that doesn’t meet your needs for the upcoming year.

Steps to Select the Best Plan During Open Enrollment

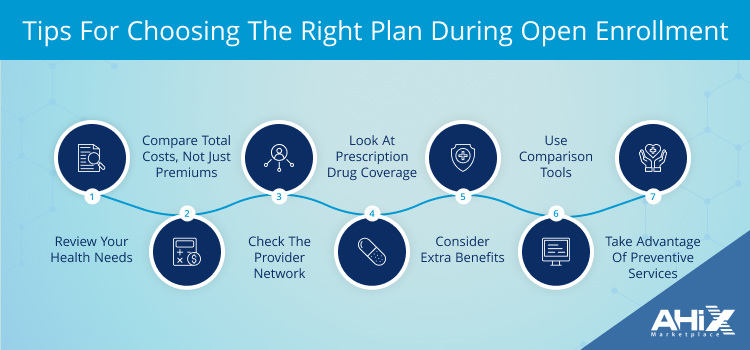

Choosing the right plan can feel overwhelming when so many options are available. The benefits open enrollment period offers are only valuable if you know how to compare and select wisely. Here are some practical tips to help you make the best decision.

1. Review Your Health Needs

Look back at your healthcare use over the past year. Did you visit specialists, need frequent prescriptions, or schedule upcoming procedures? This review will help you predict your needs for the year ahead and match them with the right coverage.

2. Compare Total Costs, Not Just Premiums

A plan with a low monthly premium may end up costing more if the deductible and copayments are high. Balance the premium with out-of-pocket costs to find the plan that fits your budget and usage.

3. Check the Provider Network

Confirm that your preferred doctors, hospitals, and specialists are in-network. Out-of-network visits can quickly become expensive, so choosing a plan with the right providers is essential.

4. Look at Prescription Drug Coverage

Prescription costs vary widely between plans. Review the drug formulary to ensure your medications are included at a reasonable cost.

5. Consider Extra Benefits

Some plans include added services like vision, dental, or mental health coverage. These extras may save you money compared to buying separate policies.

6. Use Comparison Tools

Platforms like AHiX Marketplace make this process easier by allowing you to compare plans from different providers in one place. This helps you see premiums, networks, and benefits side by side, so you can choose with confidence.

7. Take Advantage of Preventive Services

Plans that emphasize preventive care such as screenings and annual checkups scan reduce long-term health costs and improve overall well-being.

By carefully weighing these factors during open enrollment, you can select a plan that not only meets your healthcare needs but also supports your financial goals for the year.

Common Mistakes to Avoid During Health Insurance Open Enrollment

Even with the many benefits open enrollment provides, it is easy to make mistakes that leave you with less coverage or higher costs than expected. Knowing the most common errors can help you avoid them.

1. Choosing a Plan Based Only on Premiums

The cheapest monthly premium might look attractive, but if deductibles and copayments are high, your overall spending could be much more. Always look at the full cost picture.

2. Ignoring Provider Networks

Not all doctors and hospitals are covered in every plan. If you skip this step, you could lose access to your trusted providers or pay more for out-of-network visits.

3. Overlooking Prescription Costs

Many people forget to review drug coverage. If your medications are not included in a plan’s formulary, you may face high out-of-pocket expenses.

4. Forgetting to Update Dependents

If you had a new child, got married, or experienced another life change, failing to update your dependents can create gaps in coverage or billing issues.

5. Missing Deadlines

Perhaps the biggest mistake is waiting too long. Once the open enrollment period closes, you are locked into your choice for the year unless you qualify for a special enrollment event.

Avoiding these pitfalls will help you fully benefit from open enrollment and ensure your health insurance plan truly works for you.

What to Do After You Enroll in a Plan

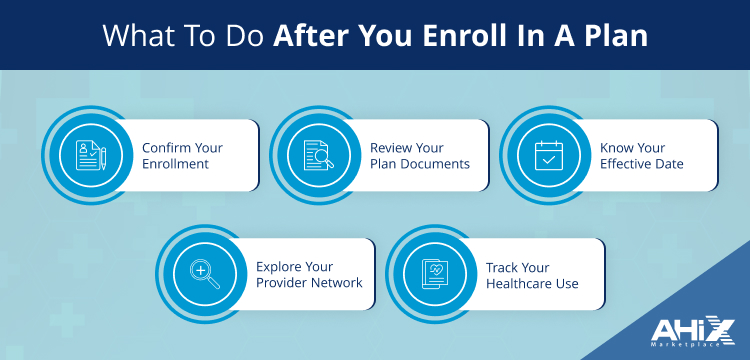

Completing your enrollment is a major step, but there are a few important tasks to handle once your new plan is active. These steps ensure you get the most out of the benefits open enrollment provided.

Confirm Your Enrollment

Check your confirmation notice or email to verify that your plan choice was processed correctly. If anything looks off, contact your marketplace or employer’s benefits office right away.

Review Your Plan Documents

When your plan begins, you should receive an insurance ID card and a summary of benefits and coverage. Keep these documents in a safe place and review them to understand your benefits.

Know Your Effective Date

Most plans take effect at the start of the new year, but some may have different dates. Confirm when your coverage officially begins so you are not caught without protection.

Explore Your Provider Network

Log in to your insurer’s website or use their directory to see which doctors and hospitals are included. This helps you schedule appointments with confidence.

Track Your Healthcare Use

Keeping records of your visits, prescriptions, and costs can help you evaluate whether your plan meets your needs. This information will be useful when the next open enrollment period comes around.

By completing these steps, you set yourself up for a smooth year and avoid surprises in your healthcare coverage

Conclusion

Open enrollment is more than just a routine step; it is your opportunity to secure coverage that truly fits your health needs and budget. The open enrollment provides range from the freedom to compare plans and adjust for life changes to saving money and gaining peace of mind for the year ahead.

By taking time to review your healthcare usage, compare costs, check provider networks, and understand plan types, you can make confident choices. Avoiding common mistakes and paying attention to deadlines ensures you get the most value from your plan.

Whether you are enrolling for the first time or reevaluating your current coverage, open enrollment is your chance to take control of your health insurance. Making informed decisions today sets you up for better care and financial protection tomorrow.

FAQs:

1. Can I switch health insurance plans after open enrollment ends?

No, unless you qualify for a special enrollment event such as marriage, divorce, having a baby, or losing other coverage.

2. What happens if I forget to enroll during the open enrollment period?

You may have to wait until the next open enrollment period. In the meantime, you could face a gap in coverage unless you qualify for special enrollment.

3. Do all employers follow the same open enrollment dates?

Not always. While the federal marketplace runs from November 1 to January 15, some employers set different deadlines. Always check with your HR or benefits office.

4. Is dental and vision coverage included in open enrollment?

Some health insurance plans offer these benefits, while others require you to purchase separate coverage. It depends on the plan and provider.

5. Can I use open enrollment to add my college-aged child to my plan?

Yes, dependents can usually be added during open enrollment if they are under age 26, even if they live away from home.

6. How do I know if I qualify for subsidies during open enrollment?

You can check eligibility when applying through the marketplace. Income, household size, and state rules determine if you qualify for premium tax credits.

7. Can I enroll in multiple health insurance plans at the same time?

Typically, you can only carry one primary health insurance plan. However, some people may have secondary coverage through a spouse or parent.

8. Are telehealth services included in plans chosen during open enrollment?

Many modern plans now include telehealth visits, but coverage varies. Review plan details to confirm if virtual care is included.

9. Does open enrollment affect Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)?

Yes. Open enrollment is when you can start, stop, or change contributions to HSAs and FSAs if your employer offers them.

10. What documents should I have ready before starting open enrollment?

It helps to gather recent medical bills, a list of medications, provider preferences, and income information if you’re applying through a marketplace.