Losing health insurance can be an overwhelming experience, especially if it happens suddenly due to a job change, divorce, or simply turning 26 and aging out of your parent’s plan. For many residents in Wyoming, understanding what to do next and how to get health insurance coverage quickly and affordably is a pressing concern. Whether you’re in Cheyenne, Casper, Laramie, or a rural county, navigating the Wyoming health insurance marketplace may feel complicated, but it doesn’t have to be.

Thanks to special enrollment periods in Wyoming, several affordable health insurance options are available, even if you’ve lost employer-sponsored insurance or government coverage like Medicaid. From ACA health insurance plans in Wyoming to short-term coverage or Medicaid eligibility, this guide will walk you through everything you need to know.

Reasons Why Wyoming Residents Lose Health Insurance?

Understanding why you lost coverage is the first step toward choosing the right replacement plan. Here are the most frequent causes Wyoming residents lose insurance, and how each situation affects your eligibility for new coverage.

1. Job Loss or Reduced Hours

Health insurance is often tied to employment. In Wyoming’s economy, driven by energy, agriculture, and seasonal industries, it’s common for individuals to lose employer-sponsored coverage due to layoffs, job changes, or reduced hours.

If this happens, you’re likely eligible for a special enrollment period. This gives you 60 days to enroll in a new qualified health insurance plan or explore alternatives like short-term health insurance through AHiX Marketplace.

2. Turning 26 and Losing Parental Coverage

Under the Affordable Care Act, dependents can remain on a parent’s health insurance plan until they turn 26. Once you reach that age, you’re required to find your own coverage. This age milestone qualifies you for a special enrollment period in Wyoming, where you can compare affordable health insurance options, including ACA-compliant plans and other short-term or private coverage options.

3. Divorce or Legal Separation

Losing coverage through a spouse due to divorce or separation is another common qualifying life event. In Wyoming, this allows you to shop for a new plan and potentially qualify for government subsidies, especially if your income changes after separation. AHiX Marketplace can guide you through this process and help determine whether you’re eligible for low-cost health insurance or Medicaid coverage in Wyoming.

4. Death of a Spouse or Family Member

When health insurance was tied to a spouse or parent who passed away, survivors often lose access to that coverage. This emotional and financial burden can be managed with timely enrollment in a new plan. You can qualify for ACA plans in Wyoming or seek temporary coverage while you explore long-term solutions.

5. Loss of Medicaid or CHIP Eligibility

Medicaid and the Children’s Health Insurance Program (CHIP) are designed to support low-income families, seniors, and children. However, changes in income or family size can make you ineligible. When this happens, you are entitled to a special enrollment period to shop for new insurance.

6. Expiration of COBRA Coverage

While COBRA allows you to keep your previous employer’s plan temporarily, it is often expensive and only lasts 18–36 months. Once it expires, you’re left needing new insurance. Fortunately, COBRA expiration is a qualifying event, and AHiX Marketplace can help you find COBRA alternatives in Wyoming that offer similar benefits at a more affordable price.

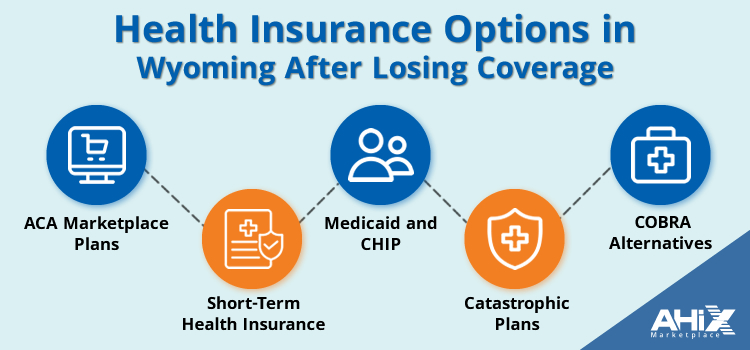

Health Insurance Options in Wyoming After Losing Coverage

After losing health coverage, Wyoming residents have access to several insurance options depending on their income, age, health needs, and reason for loss. It’s important to evaluate each option carefully to avoid any gap in coverage and unnecessary out-of-pocket expenses.

Below are the primary health insurance options available in Wyoming, including insights into how each works and who qualifies.

1. ACA Marketplace Plans

For most residents, the first place to look after losing insurance is the Affordable Care Act (ACA) marketplace. These plans are available through platforms like AHiX Marketplace, which helps individuals and families compare ACA-compliant plans in Wyoming based on their location, income, and health needs.

ACA plans are required to cover essential health benefits, including doctor visits, hospital stays, preventive care, maternity services, and prescription drugs. They are also guaranteed issue, meaning you cannot be denied coverage due to a pre-existing condition.

If you recently lost employer-sponsored insurance or Medicaid, you may qualify for premium subsidies or cost-sharing reductions. These are based on income and can significantly reduce your monthly premiums and out-of-pocket costs.

Use this option if:

- You lost your employer health insurance

- Your income qualifies for subsidies

- You want comprehensive, long-term coverage

2. Short-Term Health Insurance

If you missed the special enrollment window or simply need temporary coverage, short-term health insurance in Wyoming can be a good fallback option. These plans are designed to cover unexpected medical needs while you transition between jobs or wait for open enrollment.

Short-term plans are not required to cover all ACA benefits and may exclude pre-existing conditions, so they work best for healthy individuals needing low-cost, emergency coverage. AHiX Marketplace offers access to several flexible short-term plans that can start as soon as the next day and last up to 4 months in Wyoming.

Use this option if:

- You need immediate but temporary coverage

- You’re healthy and don’t require routine medical care

- You’re waiting for employer coverage to begin

3. Medicaid and CHIP

For residents with limited income or specific family situations, Medicaid in Wyoming offers another form of comprehensive, low-cost coverage. Eligibility is determined based on household income, family size, and other factors such as disability or pregnancy.

Children in low-income families may also qualify for CHIP (Children’s Health Insurance Program). AHiX Marketplace can help connect you with resources to determine if you qualify and guide you through the application process.

Income limits are updated annually, and Wyoming follows federal Medicaid guidelines. If your income is too high for Medicaid but still modest, you may be eligible for ACA subsidies instead.

Use this option if:

- Your income is below Wyoming Medicaid limits

- You have children who need health coverage

- You lost eligibility for employer coverage and meet the income criteria

4. Catastrophic Plans (For Under-30s or Hardship Cases)

Catastrophic health insurance is a lesser-known option available to Wyoming residents under age 30 or those who qualify for a hardship exemption. These plans offer low monthly premiums and protect against worst-case scenarios, but they come with high deductibles and limited coverage for routine care.

Catastrophic plans must still cover the same essential health benefits as ACA plans, but only after you’ve paid out of pocket up to the deductible.

Use this option if:

- You’re under 30 and want minimal monthly costs

- You’re looking for emergency-only coverage

- You don’t qualify for subsidies

5. COBRA Alternatives

COBRA allows you to extend your former employer’s insurance, but it’s usually expensive because you pay the full premium plus a 2% administration fee. If COBRA is unaffordable or has expired, AHiX Marketplace can help you find alternative coverage that’s more cost-effective, including ACA or short-term plans.

Use this option if:

- COBRA is too costly

- You want a similar plan but with lower premiums

- You’re nearing the end of COBRA coverage

How to Pick the Right Health Insurance Plan in Wyoming?

Once you’ve identified your eligibility and the types of plans available, the next step is selecting the health insurance plan that best fits your personal or family situation. Wyoming residents have access to various options, but choosing the right one depends on several factors: your health needs, budget, coverage preferences, and risk tolerance.

Here’s how to evaluate your options effectively:

1. Consider Your Budget and Monthly Premiums

Start by determining what you can realistically afford each month for health insurance. ACA plans in Wyoming are tiered (Bronze, Silver, Gold, and Platinum) based on premium costs and coverage levels. Bronze plans have lower premiums but higher deductibles, while Gold and Platinum plans have higher monthly costs and more comprehensive coverage.

If you qualify for premium subsidies based on your income, the actual cost of these plans may be significantly lower. Use AHiX Marketplace to see your eligible subsidy amount and compare real-time pricing.

Tip: Don’t just choose the cheapest plan. Consider how often you use medical services and what your maximum out-of-pocket costs might be.

2. Evaluate Your Health Needs

Your current health status should play a major role in your plan choice:

- Chronic Conditions or Regular Medications: Look for plans with low copays for specialist visits and comprehensive drug coverage.

- Healthy and Rarely See a Doctor: A high-deductible plan or short-term health insurance in Wyoming might be sufficient.

- Planning a Surgery or Pregnancy: A more comprehensive plan with better hospital coverage will reduce your out-of-pocket burden.

AHiX Marketplace offers filtering tools that allow you to compare plans based on doctor visits, medications, and hospital benefits, making it easier to match a plan to your specific medical profile.

3. Understand Network Restrictions

Not all plans cover the same doctors, hospitals, or pharmacies. Wyoming has limited health networks in rural regions, so it’s important to verify that your preferred providers are in-network.

- HMO Plans: Lower cost, but you must stay in-network for services to be covered.

- PPO Plans: More flexibility with out-of-network providers, but typically higher premiums.

- EPO Plans: A middle ground—network-based like HMOs but no referrals required.

4. Review Deductibles, Copays, and Out-of-Pocket Maximums

Beyond premiums, you’ll want to understand how much you’re responsible for when you actually use your insurance:

- Deductible: What you must pay before the plan begins covering services.

- Copays: Fixed costs for specific services like doctor visits or prescriptions.

- Out-of-Pocket Maximum: The most you’ll pay in a year before your plan covers 100% of services.

If you’re anticipating frequent care or prescriptions, look for a plan with lower out-of-pocket costs, even if the premium is slightly higher.

5. Compare Plans Through a Trusted Marketplace Like AHiX Marketplace

Trying to evaluate all these variables on your own can be overwhelming. That’s where AHiX Marketplace offers a distinct advantage. Their online tools allow Wyoming residents to:

- Compare multiple plans side-by-side

- Estimate total costs, including subsidies

- Get real-time enrollment support from licensed agents

- Enroll in ACA, short-term, or even supplemental plans—all in one place

There’s no extra cost for using AHiX Marketplace, and their support can help you avoid common enrollment mistakes that lead to claim denials or unexpected bills.

What to Do Immediately After Losing Health Insurance in Wyoming?

Losing your health insurance isn’t just a coverage issue—it can quickly become a financial emergency if you delay taking action. In Wyoming, it’s critical to respond within key deadlines to ensure you don’t miss your opportunity to enroll in a new plan or apply for financial assistance.

Here’s a step-by-step list of what to do if you’ve just lost your health insurance:

1. Confirm the Date Your Coverage Ends

Your insurance typically ends the last day of the month in which your job ended or the qualifying event occurred. It’s essential to verify the exact date so you don’t go uninsured for even a day.

Keep documentation, such as a letter from your employer or insurer, showing when your coverage ends. This is often required when applying for new insurance through a special enrollment period in Wyoming.

2. Determine If You Qualify for a Special Enrollment Period (SEP)

A loss of coverage is considered a qualifying life event, which gives you 60 days to enroll in a new health insurance plan. If you miss this window, you may have to wait until the next Open Enrollment Period or rely on short-term health insurance in Wyoming as a temporary solution.

You qualify for SEP if you’ve:

- Involuntarily lost employer coverage

- Aged out of a parent’s plan at 26

- Lost Medicaid eligibility

- Moved to a new ZIP code

- Experienced divorce or a death in the family

AHiX Marketplace helps Wyoming residents navigate SEP rules and avoid missing important deadlines.

3. Gather Financial and Household Information

If you’re applying for an ACA plan or Medicaid, you’ll need:

- Proof of income (recent pay stubs or tax documents)

- Household size and ages

- Social Security Numbers or immigration status for all applicants

Having this information ready speeds up the enrollment process and helps AHiX Marketplace determine whether you qualify for subsidies or low-cost health insurance options in Wyoming.

4. Compare Plans Based on Your Budget and Needs

Once you know your eligibility, it’s time to compare plans. With platforms like AHiX Marketplace, you can filter plans based on:

- Monthly premiums

- Deductibles and out-of-pocket limits

- Doctor and hospital networks

- Prescription drug coverage

This step ensures that you don’t just get insured—you get coverage that actually works for your lifestyle.

5. Apply and Enroll Before the Deadline

If you’re eligible for a Special Enrollment Period, you typically have 60 days from the date of your qualifying event to select a plan. With Medicaid, you can apply anytime, but delays can lead to retroactive bills or care denials. With AHiX Marketplace, Wyoming residents can complete enrollment online or with help from a licensed agent, all at no extra cost.

Conclusion: Take the Right Next Step Toward Coverage

Losing health insurance in Wyoming can feel like a setback, but it doesn’t have to leave you uninsured or unprotected. Whether you’ve lost coverage through an employer, turned 26, or experienced another qualifying life event, there are clear, actionable steps you can take to regain coverage quickly and affordably.

From ACA health plans in Wyoming to short-term insurance options and Medicaid eligibility, residents have multiple paths forward. The key is acting quickly—especially if you’re within your 60-day Special Enrollment Period. Missing that window could mean costly gaps in coverage or limited options.

If you’re unsure where to start, AHiX Marketplace makes the process easy. You can compare plans, apply for subsidies, and get expert help—at no cost to you. Whether you need comprehensive, long-term coverage or temporary protection while you transition, AHiX Marketplace helps Wyoming residents make confident, informed choices about their health insurance.

FAQ:

1. What is the first thing I should do after losing health insurance in Wyoming?

Start by confirming the exact date your coverage ends and gather documentation from your employer or insurer. From there, determine whether you truly qualify for a Special Enrollment Period in Wyoming.

2. Do I qualify for a Special Enrollment Period?

If you’ve lost coverage due to job loss, aging out of a parent’s plan, divorce, death of a spouse, or loss of Medicaid eligibility, you likely qualify. You’ll have 60 days from the date of your qualifying life event to enroll in a new health insurance plan in Wyoming.

3. What if I miss the 60-day special enrollment window?

If you miss the Special Enrollment Period, you typically must wait until the next Open Enrollment Period unless you experience another qualifying event. In the meantime, you may be able to get short-term health insurance in Wyoming to maintain temporary coverage.

4. Can I get financial help for health insurance if I’m unemployed or have low income?

Yes. If your income is within a certain range, you may qualify for premium subsidies under the Affordable Care Act, which lower your monthly costs. You might also be eligible for Medicaid in Wyoming or other low-income health insurance options. AHiX Marketplace can help determine your eligibility and estimate your savings instantly.

5. Is it better to choose a short-term plan or an ACA plan?

It depends on your situation. ACA plans in Wyoming offer full coverage, including pre-existing conditions and preventive services. Short-term plans are typically cheaper but limited in benefits and duration. They can be a useful bridge if you’re between jobs or waiting for employer benefits to begin.

6. How do I know which plan includes my doctor or covers my prescriptions?

AHiX Marketplace’s plan comparison tools allow you to search by provider, hospital, and drug formularies. This helps ensure that the plan you choose includes your preferred doctors and covers any medications you rely on.

7. Does AHiX Marketplace charge a fee to help me enroll in health insurance?

No. AHiX Marketplace offers free support to help you compare plans, apply for subsidies, and enroll in coverage. Licensed agents are available to assist you every step of the way at no additional cost.

8. What happens if I remain uninsured in Wyoming?

Going without health insurance increases your financial risk if you need medical care. While Wyoming does not impose a state-level penalty for being uninsured, medical bills from emergencies or hospitalizations can be financially devastating. Getting coverage, even a temporary plan, is strongly recommended.