The outlook for healthcare insurance in Alabama is looking up. Premiums are dropping, and about 95% of enrollees who use the marketplace exchange receive premium subsidies.

In Alabama, despite not adopting the Medicaid expansion, individuals earning as little as $12,490 can qualify for premium subsidies. This consistency ensures that health insurance and its coverage remain stable year after year, protecting the majority of enrollees.

Best Health Insurance in Alabama

Purchasing affordable medical insurance in Alabama is more than just finding the lowest-priced plan. it’s about understanding your health needs today and predicting future needs. This includes considering potential hospital stays, tests, or medication and how often you’ll use such services.

Your first option is to use a health exchange to find appropriate ACA-compliant health plans. These plans align with the Affordable Care Act and, as such, offer minimum essential coverage. “MEC” includes hospitalization services, pregnancy care, prescription drug coverage, and even mental health and substance use disorder support services.

These plans can help cover individual, family, and short-term healthcare costs.

1) Alabama Health Insurance Marketplace (ACA)

ACA plans are the most popular option for purchasing cheap health insurance plans in Alabama. Although, if you work for a larger company, they typically offer you group health insurance, coverage provided by employers.

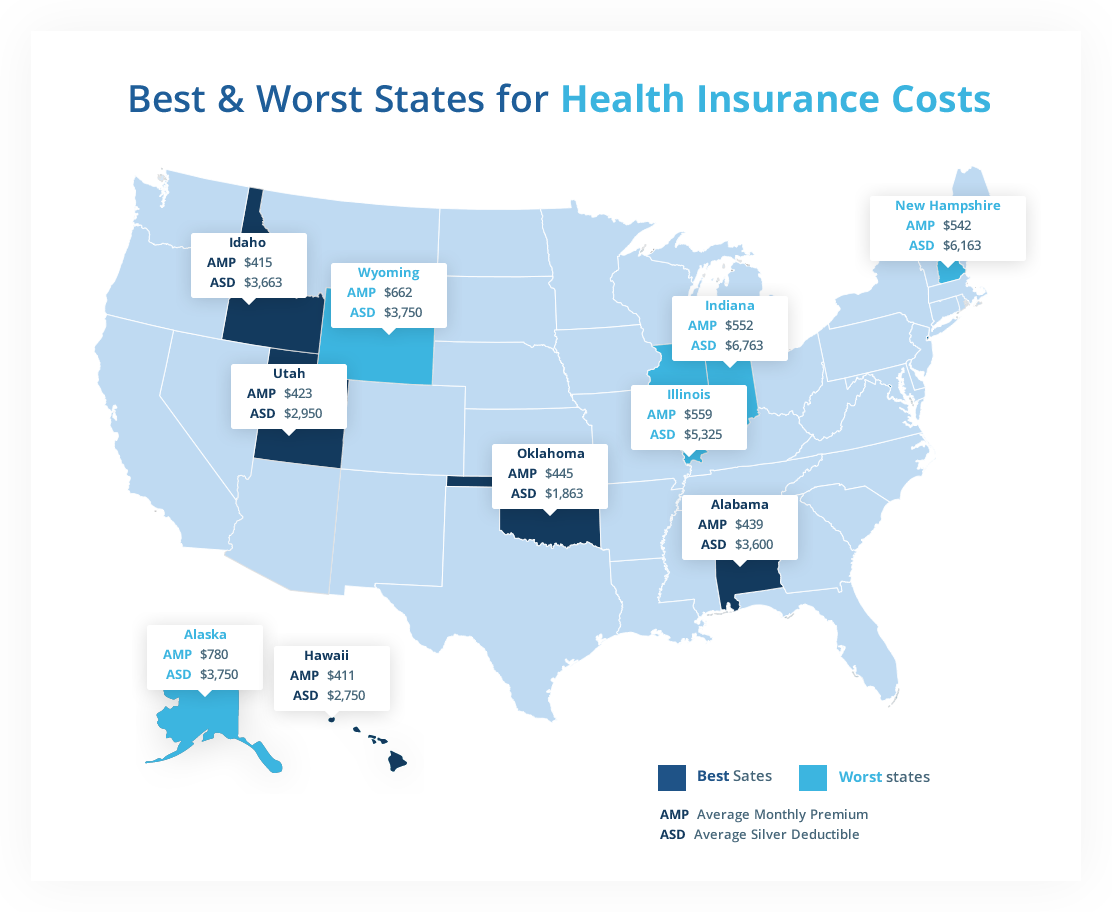

Furthermore, if you’re an independent contractor or if your job doesn’t provide group health insurance, you’ll need individual coverage. This simply means that the responsibility of finding a health insurance plan rests solely on you. After researching and choosing the best plan, you’re also responsible for enrolling during the Open Enrollment period. The good news for Alabama residents is that your state is one of the best-ranked when it comes to affordable and high-quality health insurance coverage.

Health insurance plan types and metal tiers can be confusing due to the different terms used. Metal tiers simply refer to the level of coverage you’re responsible for.

The Affordable Care Act, often called "Obamacare," mandates that plans cover at least 60%, with slight variations. Alabama Health care follows the same system as the rest of the country:

Alabama Health Insurance Plans Fit for Your Needs and Budget

Bronze

Bronze plans have the lowest premiums but also feature high out-of-pocket costs. This works if you’re young or in relatively good health and don’t anticipate needing frequent medical care.

Silver

Silver plans are a balance between Gold and Bronze plans, offering reasonable monthly fees and manageable costs when you need care. They also qualify for cost-sharing reductions, benefiting many households not eligible for Medicaid.

Gold

Typically used by individuals who are older and will need frequent access to medical care. You’ll pay higher premiums, but your deductibles are comparably lower to help reduce out-of-pocket expenses.

Platinum

Offering the very highest level of coverage — up to 90% — while you pay 10%. However, to receive this level of coverage, you will pay the highest premiums of all metal tiers.

Catastrophic

This option is only available to individuals younger than 30 years of age. However, it’s worth noting that you can apply for Catastrophic plans in Alabama, regardless of your age. This is strictly for individuals who qualify for a hardship exemption. If eligible, you must keep in mind you won’t qualify for any premium tax credits.

In Alabama, there are three popular types of healthcare coverage you can opt for. These include:

HMOs form a tight-knit healthcare network of primary care doctors, specialists, and hospitals. All members of this network either work for or have contracts with the HMO. Generally, HMOs don’t cover care outside their network unless it’s an emergency, allowing them to offer lower costs.

PPOs offer flexibility by allowing you to select from a large network of doctors and hospitals. Not only can you see a specialist without a referral, but you also receive partial reimbursement for out-of-network visits. With PPOs, using in-network providers is cheaper; however, you can also choose outside providers at a higher cost.

POS plans combine PPO and HMO advantages, giving the option to choose providers and save money in-network. You’ll pay part of in-network medical costs upfront, then claim reimbursement. However, to see a specialist, you’ll need a referral from your primary care doctor, similar to HMOs.

2) Short-Term Health Insurance in Alabama

Should you find yourself unable to access or benefit from ACA-compliant health plans, consider exploring temporary health insurance in Alabama. People often use the terms "QHP" or "Qualified Health Plans" when discussing ACA plans. However, people commonly refer to."Short-term insurance", as "Non-Qualified" or "Non-ACA".

This means Short-term insurance providers do not have to cover all 10 essential health benefits, unlike Qualified Health Plans. For example, Short-term plans do not cover maternity, mental health, substance abuse, or pre-existing conditions. You must also answer a set of medical eligibility questions to qualify for coverage, which ACA-compliant plans do not allow.

Opt for short-term insurance coverage in Alabama if you meet the following criteria:

- You’ve missed the Open Enrollment period and need a healthcare plan for the rest of the year until Enrollment reopens.

- You need an affordable alternative to an ACA plan. In Alabama, continuous coverage under short-term health insurance is now no more than four months, including renewals.

- If you recently lost your job and no longer have group health insurance. This may mean you need a bridge until you can get a qualified health insurance plan.

- If you have recently graduated from college and no longer qualify for your parent’s plan, you might need short term insurance while job searching.

- At Ahix, we clarify that individuals not lawfully present in the U.S. are ineligible for Marketplace or most insurance plans, including short-term health insurance.

Applying for Alabama Health Insurance Coverage

After deciding on the type of plan you want, the next step is to research the available providers and plans. You will also need to gather application documents for enrollment. If you’re an immigrant, your documentation requirements differ from U.S. citizens living in Alabama.

If you’re a U.S. citizen living in Alabama, make sure you have the following documents ready for your Marketplace application:

- Information about your household

- Home and mailing address for everyone applying

- Basic information about everyone applying and their relationship to you

- Social security numbers for everyone applying

- Tax information such as filing separately or jointly, and any dependents

- Employer and income information

- An estimate of household income

- Information about anyone currently covered, including Medicaid, CHIP, Medicare, VA health care, etc.

At www.ahix.com, we streamline the health insurance research and selection process for you. Our specialized agents can help guide your decisions with personalized advice over the phone or through our chat feature. Find the perfect healthcare plan for you and your family using our platform. Enroll easily to ensure medical coverage for yourself and your loved ones. Learn more about how AHiX Marketplace Marketplace is making affordable healthcare in Alabama even more accessible to you.

Best cheap health insurance companies in Alabama

In 2025, Blue Cross Blue Shield gained recognition in Alabama. They provided affordable plans with high ratings and offered a wide network of health providers across the entire state. In contrast, UnitedHealthcare serves only 19% of counties, totaling 13 out of 67. However, both companies present affordable health insurance coverage in Alabama for you and your family.

Cheapest health insurance plan by county

The cost of health insurance plans can vary across different counties in Alabama. When considering Blue Cross Blue Shield (BCBS) alternatives, they provide coverage all through the state. Some of the most affordable HMO options for a 35-year-old female in 2026 include:

- Jefferson County: Anticipate a monthly premium of $405/month, unsubsidized.

- Madison County: The cost for a nearly identical plan is $424/month, unsubsidized.

Remember to explore options thoroughly to ensure you’re getting the best rates tailored to your needs.

Frequently asked questions

-

Can you get cheap health insurance in Alabama?

Obtaining affordable health insurance in Alabama is feasible through several options. Residents may explore subsidized Qualified Health Plans, which offer premiums as low as $0/month for individuals meeting specific income criteria. Additionally, Non-Qualified plans, like short-term health insurance, are also available for those un-subsidized and looking for an alternative.

It’s important to consider both premium costs and the out-of-pocket maximum to ensure affordable and sufficient coverage. This balance helps secure a plan that meets both your healthcare needs and budget.

-

How to Apply for Medicaid in Alabama?

-

Medicare Advantage Plans in Alabama

-

How to get health insurance coverage in Alabama?

-

When is the Open Enrollment Period for health insurance in Alabama?

-

Are there any state-specific health insurance programs in Alabama?

-

What if I miss the Open Enrollment Period?

-

Can I get health insurance plans in Alabama if I have a pre-existing condition?

-

How much does health insurance cost in Alabama?

-

Are there any tax credits or subsidies available to assist low-income individuals in paying for health insurance?

-

What are the essential health benefits covered under plans in Alabama?

-

Does Alabama require health insurance?

-

Does Alabama have free health insurance?

-

What is the best health insurance in Alabama?

-

Can you get free health insurance in Alabama?

Finding the Right Alabama Health Insurance Plans

Wanting affordable coverage that suits your needs can be a lot to handle. The good news is that AHiX Marketplace Marketplace can do the work of searching for the right plan for you. AHiX Marketplace is an affordable exchange where you can browse for qualified and non-qualified plans. Reach out or find your new policy today.