Much like the insurance that you purchase for your car, health insurance is another necessity that everybody should have. Although it is not mandatory in many states, health insurance the best way to help cover yourself when the unexpected happens.

“The biggest benefit is to have financial protection and the peace of mind of knowing that you can get access to affordable healthcare when you need it,” says Howard Yeh, the CEO of HealthCare.com. “You might be hesitant to see a doctor even when it’s medically necessary because you don’t want to or cannot pay for costs out-of-pocket.”

It certainly can be tempting to go without health insurance since the costs are overwhelming. But by finding out the kind of coverage you need, you’ll be able to find a plan that suits yours and your family’s budget. First, it’s best to get an idea of how the five main factors affect the cost of health insurance.

What is the Average Cost of Health Insurance?

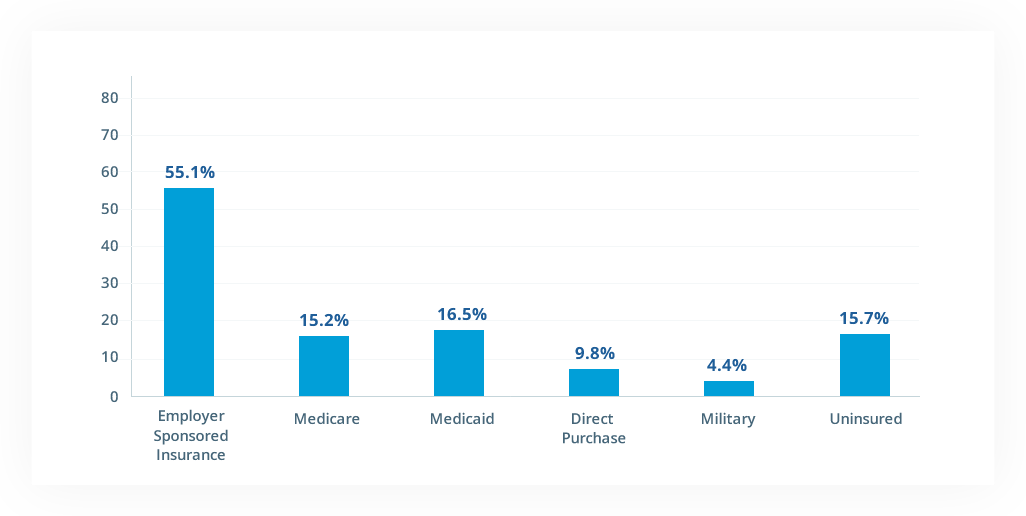

Just over 55% of Americans use employer-based health coverage, which means most people depend on their employer’s benefits to help cover them and potentially their spouse and dependents for health insurance costs. Under this plan, the average price for individual health insurance is about $440 per month and $1,168 per month for family coverage.

All qualified plans comply with the Affordable Care Act (ACA) regulations, which mandates coverage for the following the essential health benefits:

- Doctor’s services

- Inpatient and outpatient hospital care

- Prescription drug coverage

-

Pregnancy and childbirth

-

Mental health services

- Sometimes more services

Although these services are excellent to have, health insurance prices can still get very costly. That’s why many people utilize other options, such as Medicare, Medicaid, or non-qualified options that are not ACA-compliant.

Before you begin looking for health insurance, it’s vital to know that it’s all about the factors that affect your rates. Several things come into play when insurance companies are measuring the cost of your premiums, like your age, location, tobacco usage, and more.

Factor #1: Age

There is a significant difference between a young adult and an older adult receiving medical coverage. For starters, older adults are three times more likely to pay more for a premium. This is because younger people are less likely to have chronic health issues — and also less likely to go to the doctor.

Factor #2: Location

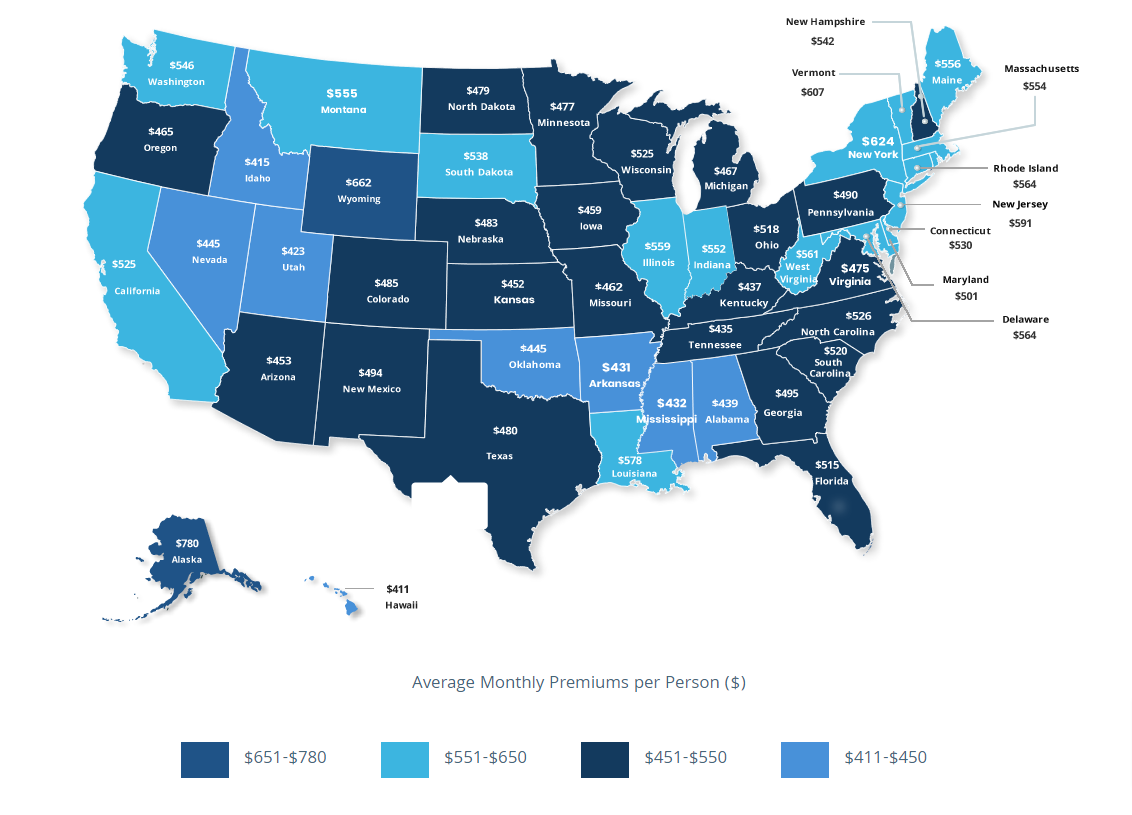

Where you live can affect the price you pay for insurance. For instance, Wyoming is reported to have the highest average cost, whereas southern states like Kentucky, Alabama, Mississippi, and more have a lower average cost:

Another location-based consideration is enforcement of the ACA’s individual mandate. Although the individual mandate is no longer enforced federally, some states still require that each citizen gets health insurance, such as:

- California

- Washington, D.C

- New Jersey

- Vermont

There are several more states considering individual mandate as well, such as Washington, Oregon, Hawaii, Minnesota, Maryland, Connecticut, and Rhode Island. Additionally, your health insurance companies will consider the cost of living in your location to help determine a fair number.

Factor #3: Tobacco Use

Health insurance companies have to assess physical and medical risk factors — which is why tobacco usage is now a primary factor that is taken into account. Since tobacco users are more likely to have serious health risks, many insurers could charge them up to 50% more than those who don’t use it at all.

Factor #4: Individual or Family Plans

You already know that the average individual pays $440 per month, and the average cost of health insurance for a family of 4 is $1,168 — but why? Simply, anybody with a spouse or dependents can expect to pay more than individuals alone. This is the big difference between individual and family plans since insurance is not only covering one individual but their spouses and children as well.

If you are married, you have a bit more flexibility. You can choose to retain your individual plan or expand to a family health insurance plan if you would like your spouse covered. The average health insurance cost for a married couple depends on other factors as well, but shopping separately can potentially save couples in this scenario money on their premiums.

How Does Gender Affect Health Insurance Costs?

Under the ACA, health insurers cannot discriminate based on gender, but if you choose to go with non-qualified health insurance, it’s essential to know your gender is going to affect the cost of your health insurance plan.

A single male typically has the lowest premiums when compared to women, and the average health insurance cost for a single female is slightly more per year. This is because women are more likely to go to the doctor, take prescriptions, and are more subject to chronic diseases.

Factor #5: Plan Category

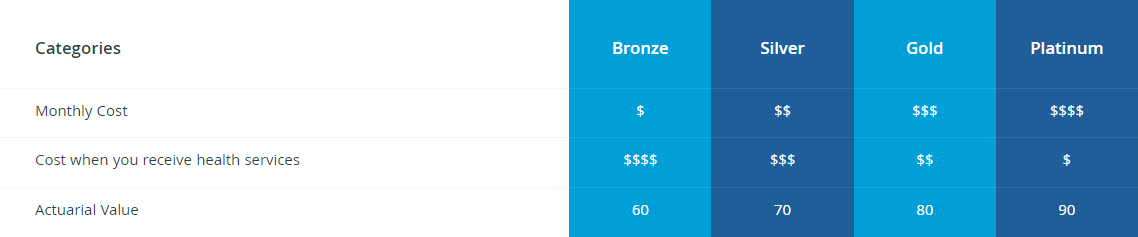

Depending on how you choose to receive your insurance, you have the choice to select your plan type, which is based on a metal system of Platinum, Gold, Silver, and Bronze. There are also Catastrophic options.

Actuarial Value is the percentage of average total costs for covered health services that a plan will cover.

Tier #1: Platinum

Platinum coverage has the highest premiums where insurance will pay 90% of your healthcare costs while you pay 10%. This option is great for those who want a lot of healthcare with several visits and prescription medication requirements.

Tier #2: Gold

Gold coverage has medium-ranged premiums where your insurance covers 80% of healthcare costs while you pay 20%. This plan is ideal for those who want to save money on monthly premiums while keeping out-of-pocket costs low.

Tier #3: Silver

Silver coverage has low-to-medium premiums where your insurance covers 70% of healthcare costs while you pay 30%. Depending on your income, you might be eligible for a cost-sharing reduction subsidy.

Tier #4: Bronze

Bronze coverage has lower monthly premiums but higher out-of-pocket costs, where your insurance pays 60% for healthcare costs and you pay 40%. This is better for those who don’t need a lot of healthcare services.

Tier #5: Catastrophic

Catastrophic plans are reserved for those who cannot afford a traditional health insurance plan but want coverage in emergency situations. Also known as major medical insurance, you must be under 30 years old and complete a hardship exemption application to see if you qualify.

Conclusion

If you are considering health insurance for you and your family, then it’s vital to become familiar with the critical factors that affect your health insurance costs. Your age, location, tobacco usage, plan type, and plan category are going to give you a better idea of how much you might pay for your premium. There are also options outside of typical healthcare that are not ACA-compliant but might offer cheaper rates with the coverage you need.

FAQs About the Cost of Health Insurance

1. How much does health insurance cost per month?

The cost of health insurance per month varies depending on factors such as your age, location, coverage level, and the insurance provider. On average, individuals may pay anywhere from $100 to $500 per month for health insurance premiums.

2. How much does health insurance cost without a job?

Health insurance costs without a job can be significant, as you may need to purchase coverage independently. Without employer subsidies, premiums for individual health insurance plans can range from a few hundred to over a thousand dollars per month, depending on your needs and coverage options.

3. How much does health insurance cost for self-employed individuals?

Health insurance costs for self-employed individuals can vary widely based on factors such as age, location, coverage level, and health history. On average, self-employed individuals may pay anywhere from $300 to $800 per month for health insurance premiums, depending on their specific needs and the type of plan chosen.

4. How do I find an affordable health insurance plan?

Finding an affordable health insurance plan involves researching different options, comparing coverage and costs, and considering factors such as premiums, deductibles, and out-of-pocket expenses. Utilize online comparison tools, consult with licensed insurance brokers, and explore government-sponsored programs like Medicaid or the Affordable Care Act marketplace to find a plan that fits your budget and coverage needs.

5. What can you expect to pay for health insurance deductibles?

Health insurance deductibles vary depending on the plan and coverage level you choose. Deductibles typically range from a few hundred to several thousand dollars per year. Higher-deductible plans often have lower monthly premiums but require you to pay more out-of-pocket before insurance coverage kicks in. Evaluate your healthcare needs and financial situation to determine the deductible that works best for you.

Are you wondering about the cost of health insurance?” At AHIX, we understand the importance of affordability when selecting a health insurance plan. Our licensed insurance brokers not only provide guidance on coverage options but also offer valuable insights into pricing factors. Whether you’re exploring individual plans, employer-sponsored options, or government programs like Medicaid, our team can help you understand the cost implications and find a plan that fits your budget. With AHIX, you’ll have the support you need to navigate the complexities of health insurance and make informed decisions about your coverage. Contact us today at 800.800.5735, Monday through Friday, from 9am to 7:30pm ET, or email us at sales@ahix.com to learn more about how we can assist you in finding affordable health insurance solutions tailored to your needs.