Bringing a new life into the world is exciting, but it also comes with many responsibilities, especially when it comes to healthcare. One of the most important steps you can take before pregnancy is making sure you have the best maternity health coverage.

From prenatal visits and ultrasounds to delivery and newborn care, the costs can quickly add up. Without proper maternity health coverage, even routine care during pregnancy could lead to unexpected bills. In the U.S., a typical hospital birth can cost between $10,000 and $30,000 without insurance, sometimes more if complications arise.

The good news? You don’t have to navigate this alone. Whether you’re already expecting or planning to start a family soon, understanding your pregnancy insurance options will help you make smarter choices for both your health and your budget.

In this guide, we’ll walk you through everything you need to know about choosing the right health insurance for pregnancy, what it covers, what to avoid, and how to find a plan that actually meets your needs, including coverage for newborn care and prenatal care.

What is Maternity Health Coverage?

Maternity health coverage is a type of health insurance that helps cover medical costs related to pregnancy, childbirth, and care after the baby is born. It’s to reduce the financial burden of one of life’s most significant events.

When you enroll in a plan that includes health insurance for pregnancy, you typically gain access to essential services such as:

- Prenatal care (check-ups, blood tests, ultrasounds)

- Labor and delivery (hospital or birthing center costs)

- Postpartum care (follow-up visits and screenings for the mother)

- Newborn care (initial screenings, vaccinations, and doctor visits)

These services aren’t just “nice to have”; they’re critical for keeping both mother and baby healthy throughout the journey. Without proper coverage, these routine medical needs can quickly become unaffordable.

It’s important to know that not all insurance plans offer full pregnancy-related services by default. Some may offer limited coverage or require higher out-of-pocket costs. That’s why identifying the best maternity health coverage, one that supports your care from start to finish is so important before you enroll.

Why You Shouldn’t Skip Maternity Coverage?

If you’re planning to have a baby or even thinking about it, maternity health coverage isn’t optional. It’s a must.

The medical costs of childbirth can be surprisingly high, even for a healthy pregnancy. Without insurance, a standard delivery can cost $10,000 or more. If a C-section is needed or there are any complications, those costs can easily double. And that’s just for the delivery, prenatal visits, lab work, ultrasounds, and postnatal care add to the bill.

But it’s not just about the money.

Skipping maternity coverage means you may not get access to regular check-ups, important screenings, or proper care during complications. These gaps in care can affect your health and your baby’s well-being.

With the right health coverage during pregnancy, you can:

- Avoid high out-of-pocket maternity costs

- Get timely prenatal care to spot problems early

- Ensure safe delivery options with trusted providers

- Access necessary care for your baby in the first critical days

Even if you’re healthy, pregnancy is unpredictable. That’s why having the right maternity health coverage in place before you need it is one of the smartest decisions you can make for your growing family.

What to Look for in the Best Maternity Health Coverage?

Choosing the best maternity health coverage isn’t just about picking any plan that says “maternity included.” It’s about finding one that actually supports you medically, financially, and emotionally through every stage of pregnancy.

Here are the most important things to check before enrolling:

1. What’s Covered (and What’s Not)

Look closely at the list of covered maternity services. A good plan should include:

- Prenatal care: Check-ups, routine blood work, ultrasounds, screenings

- Labor & delivery: Hospital stay, epidural (if needed), C-section (if required)

- Postpartum coverage: Follow-up visits, mental health screening, lactation support

- Newborn care: Initial exams, vaccinations, and screenings for your baby

If any of these are missing or limited, the plan might not be worth the risk.

2. Cost Breakdown

Understanding your share of the costs is crucial. Ask these questions:

- What’s the monthly premium?

- What is the maternity deductible (the amount you pay before insurance kicks in)?

- What are the copays or coinsurance for doctor visits and delivery?

- What is the out-of-pocket maximum?

A plan with a low premium might sound appealing, but if the deductible is too high, you could end up paying more overall.

3. Provider Network Access

Check which doctors, OB-GYNs, and hospitals are in-network. Choosing a plan with a strong provider network means:

- You’ll have access to trusted maternity specialists

- You’ll avoid surprise bills from out-of-network care

- You can deliver in your preferred hospital or birthing center

Also, make sure pediatricians for newborn care are covered under the same network.

4. Support Services

Some plans go beyond the basics and offer additional support, such as:

- 24/7 nurse hotlines

- Prenatal education classes

- Postpartum mental health services

These extras can make a big difference in your experience.

When you’re comparing maternity coverage options, make sure the plan checks all these boxes, not just for price, but for value. You want coverage that works for your unique needs, not just what’s written on paper.

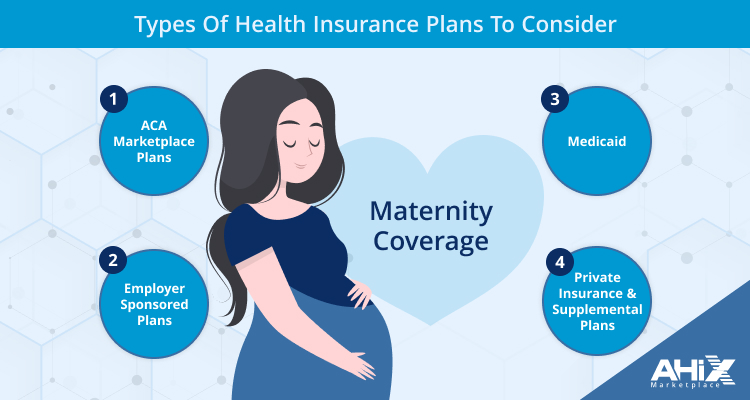

Types of Health Insurance Plans That Offer Maternity Coverage

If you’re planning to grow your family, knowing where to find maternity health insurance is essential. Not all plans are the same, and depending on your situation, like job status, income, or timing, some options may fit better than others.

Here are the most common types of health insurance for maternity coverage available today:

1. ACA Marketplace Plans (Affordable Care Act)

All plans sold through the ACA Marketplace are required to include maternity and newborn health insurance benefits. This makes them a reliable choice for individuals and families who don’t have coverage through an employer.

What’s typically covered:

- Regular prenatal visits

- Delivery (hospital or birthing center)

- Postpartum care and support

- Newborn screenings and immunizations

These maternity health insurance plans are comprehensive and regulated, making them ideal for those seeking broad coverage and financial protection.

2. Employer-Sponsored Plans

If you’re employed full-time, your workplace might offer a group plan with built-in maternity care health insurance. These often have lower premiums and wider networks because employers share the cost with you.

Before enrolling, be sure to check:

- Is maternity coverage included automatically?

- Are your preferred OB-GYNs and hospitals in-network?

- What are the deductible and co-pay amounts for maternity services?

This can be one of the best health insurance for maternity options if your employer offers a strong plan.

3. Medicaid (For Eligible Low-Income Individuals)

Medicaid provides good maternity health insurance if you qualify based on income or pregnancy status. It offers full coverage for prenatal, delivery, and postpartum care, and typically includes extra services like nutrition programs or home visit support.

Since it varies by state, check your local Medicaid office for eligibility and benefits.

4. Private Insurance & Supplemental Plans

If you don’t qualify for employer or government plans, private insurers offer individual maternity health insurance plans. Some also provide supplemental maternity riders, which you can add to your existing health policy.

These are helpful if your current coverage is limited, but make sure to:

- Compare costs carefully

- Look closely at what’s actually covered

- Confirm timelines, as some plans have waiting periods

How to Choose the Right Time to Get Maternity Health Insurance

Timing is everything when it comes to enrolling in maternity health insurance. While some people assume they can wait until after becoming pregnant, that’s not always the case.

Most plans, including those on the ACA Marketplace and private maternity health insurance plans require you to enroll during specific periods. Missing those windows could mean going months without coverage or facing high out-of-pocket costs.

1. Enroll Before You’re Pregnant

The smartest move is to secure your pregnancy insurance before you actually become pregnant. That way, you’ll be covered from the very first prenatal visit to postpartum care and newborn checkups.

Plans like affordable health insurance with maternity benefits usually start covering care only after the plan becomes active. Waiting until after conception might delay access to early tests or essential care.

2. Open Enrollment Periods

For ACA marketplace plans, you can sign up during the yearly Open Enrollment Period. This typically runs from November through mid-January, depending on your state.

If you miss it, you’ll need to qualify for a Special Enrollment Period, which only applies after certain life events.

3. Special Enrollment Events (SEPs)

You may qualify to enroll outside of Open Enrollment if you’ve recently experienced:

- Loss of job-based coverage

- Marriage or divorce

- Moving to a new coverage area

- Birth or adoption of a child

But here’s the catch: being pregnantalone does not qualify you for a SEP under ACA plans. That’s why planning early is crucial.

4. Medicaid Enrollment Is Open Year-Round

If you qualify for Medicaid, you can apply any time before or during pregnancy. Many pregnant individuals find Medicaid to be a helpful option because it offers comprehensive maternity care with little or no cost.

5. Employer Plan Deadlines Vary

If you have access to an employer-sponsored plan, pay attention to HR deadlines. Some companies only allow enrollment once a year, while others offer rolling enrollment for new hires or qualifying life events

Planning ahead gives you the best chance of accessing the best maternity health coverage not only for care but for peace of mind. Waiting too long could limit your options and delay necessary treatment when you need it most.

How to Compare Maternity Insurance Plans Easily

When you’re choosing a maternity insurance plan, it’s not just about picking one that sounds good, it’s about finding the one that meets your needs, fits your budget, and supports you through every stage of pregnancy.

Here are the key things to compare:

1. What’s Included in the Plan

Make sure the plan covers the full range of maternity and newborn services, including:

- Prenatal visits and testing

- Labor and hospital delivery

- Postpartum follow-up care

- Newborn checkups and immunizations

Some plans may skip helpful services like breastfeeding support or mental health counseling so read the benefit list closely.

2. Out-of-Pocket Costs

Beyond the monthly premium, review:

- Deductibles (how much you pay before coverage begins)

- Copayments and coinsurance for each visit

- The out-of-pocket maximum (your total spending limit for the year)

A low monthly premium might look attractive, but a high deductible could mean paying much more overall.

3. Doctor and Hospital Access

Check whether your preferred hospitals, OB-GYNs, and pediatricians are in-network. Going out-of-network often leads to much higher bills or no coverage at all.

4. Extra Features That Support You

Some plans offer added value, such as:

- 24/7 nurse helplines

- Access to childbirth education

- Mobile tools to manage appointments or billing

These features can make your pregnancy experience smoother and more manageable.

5. Trusted Reviews and Customer Experience

Look at real reviews from families who have used the plan. If many people report billing issues, delays in approvals, or poor service during delivery, that’s a red flag.

6. Use Comparison Tools to Make It Easier

Instead of trying to evaluate everything manually, you can use tools like AHiX Marketplace to compare multiple maternity insurance plans side-by-side. It lets you filter based on cost, coverage, provider access, and more, all in one place.

Mistakes to Avoid When Picking Maternity Insurance

Finding a maternity plan that fits your medical needs, financial situation, and provider preferences can feel overwhelming. That’s where AHiX Marketplace becomes a helpful partner, not just a platform.

Whether you’re planning a pregnancy or already expecting, AHiX offers tools and support that make the process simpler, faster, and more personalized.

1. Easy Plan Comparisons

Instead of jumping between different insurer websites, AHiX allows you to compare multiple plans side by side. You can filter based on:

- Monthly cost

- Deductible and out-of-pocket limits

- Covered maternity and newborn services

- In-network doctors and hospitals

This saves hours of research and helps you quickly spot plans that meet your specific needs.

2. Personalized Recommendations

Every family’s situation is different. AHiX helps guide you to coverage options that fit your:

- Budget

- Location

- Maternity care preferences

- Coverage timing

The platform uses smart tools to match your profile with plans that make sense for your goals.

3. Support Every Step of the Way

Need help enrolling or understanding benefits? AHiX offers:

- Live support from licensed insurance advisors

- Clear explanations of what each plan includes

- Help understanding deadlines and special enrollment windows

4. Trusted and Transparent

There are no hidden fees, confusing language, or upsells. AHiX is built to make health coverage for maternity easier to understand and easier to access, especially during such a meaningful time in your life.

Whether you’re comparing employer plans, private insurance, or ACA marketplace options, AHiX gives you the clarity and control you need to make a confident decision.

How AHiX Helps You Find the Right Maternity Coverage

Finding a maternity plan that fits your medical needs, financial situation, and provider preferences can feel overwhelming. That’s where AHiX Marketplace becomes a helpful partner, not just a platform.

Whether you’re planning a pregnancy or already expecting, AHiX offers tools and support that make the process simpler, faster, and more personalized.

1. Easy Plan Comparisons

Instead of jumping between different insurer websites, AHiX allows you to compare multiple plans side by side. You can filter based on:

- Monthly cost

- Deductible and out-of-pocket limits

- Covered maternity and newborn service

- In-network doctors and hospitals

This saves hours of research and helps you quickly spot plans that meet your specific needs.

2. Personalized Recommendations

Every family’s situation is different. AHiX helps guide you to coverage options that fit your:

- Budget

- Location

- Maternity care preferences

- Coverage timing

The platform uses smart tools to match your profile with plans that make sense for your goals.

3. Support Every Step of the Way

Need help enrolling or understanding benefits? AHiX offers:

- Live support from licensed insurance advisors

- Clear explanations of what each plan includes

- Help understanding deadlines and special enrollment windows

4. Trusted and Transparent

There are no hidden fees, confusing language, or upsells. AHiX is built to make health coverage for maternity easier to understand and easier to access, especially during such a meaningful time in your life.

Whether you’re comparing employer plans, private insurance, or ACA marketplace options, AHiX gives you the clarity and control you need to make a confident decision.

Conclusion:

Preparing for a baby comes with a lot of decisions but choosing the right health insurance shouldn’t feel overwhelming. With the best maternity health coverage, you’re not just protecting your budget, you’re making sure you and your baby get the care you both deserve at every stage.

From prenatal checkups to delivery and newborn care, the right plan gives you peace of mind, predictable costs, and access to the providers you trust. But not all plans are created equal. That’s why it’s worth taking time to compare your options, understand what’s included, and enroll at the right time.

If you’re ready to find a plan that fits your needs and supports your growing family, platforms like AHiX Marketplace make it easy to explore and compare your options all in one place.

FAQs

1. Is it possible to get maternity insurance after becoming pregnant?

In most cases, no. Many insurance companies don’t allow new maternity coverage after pregnancy begins unless you’re eligible for Medicaid or a Special Enrollment Period.

2. Do all health insurance plans cover maternity care?

No, not all plans offer full maternity coverage. Some only include basic services or require extra add-ons. It’s important to review what’s included before you enroll.

3. What is the best affordable maternity insurance for first-time moms?

The best option depends on your income, health needs, and timing. ACA Marketplace plans and Medicaid (if you qualify) offer strong coverage for first-time moms at a lower cost.

4. How can I estimate my total maternity costs with insurance?

You’ll need to consider your premium, deductible, co-pays, and out-of-pocket maximum. Also check if your doctors and hospital are in-network.

5. Can I change my maternity plan during pregnancy?

Usually, you can only change your plan during Open Enrollment or if you qualify for a Special Enrollment Period due to a major life event.

6. Can I add my newborn to my plan right after birth?

Yes, you typically have 30 days after your baby is born to add them to your health plan. Coverage can start from the baby’s birth date if added in time.

7. Are C-sections covered under maternity health insurance?

Yes, most plans that include delivery coverage also cover C-sections—both scheduled and emergency. Costs may vary based on your plan and hospital network.

8. Does maternity insurance cover ultrasounds and prenatal tests?

Most comprehensive plans include standard ultrasounds and tests. Advanced screenings may not be fully covered, so review the plan details carefully.

9. Can self-employed people get good maternity coverage?

Yes, self-employed individuals can buy plans through the ACA Marketplace, which include prenatal, delivery, and postpartum care. Subsidies may help reduce costs.

10. What happens if I don’t have maternity insurance during pregnancy?

You’ll likely have to pay for care out of pocket. However, programs like Medicaid may help if you qualify even after you’re already pregnant.